HRMS PAYROLL SOFTWARE

Easy payroll. Seriously.

Eddy helps you keep track of everything you need. So when it’s time to run payroll, you can be done in just a few minutes, with no manual data entry. Seriously easy.

Get a demo

The secret to easy payroll? A simple all-in-one HRMS payroll software

Eddy makes running payroll easy, quick, and stress-free by eliminating double entry, and by providing you with full-service tax filing, comprehensive payroll reporting, excellent employee experience, and superior customer support.

Track everything you need in Eddy, then watch it magically appear in Payroll

Manual data entry in another payroll system? Not with Eddy. Save those fingers for more important work.

- If you are using Eddy’s core HR tools, you already have all the data you need. At the end of the pay period, it all flows automatically right into Payroll.

- Eddy makes it easy to review and approve all hours worked and time off requests (you can even assign this task to managers), so hours are accurate when it’s time to run payroll.

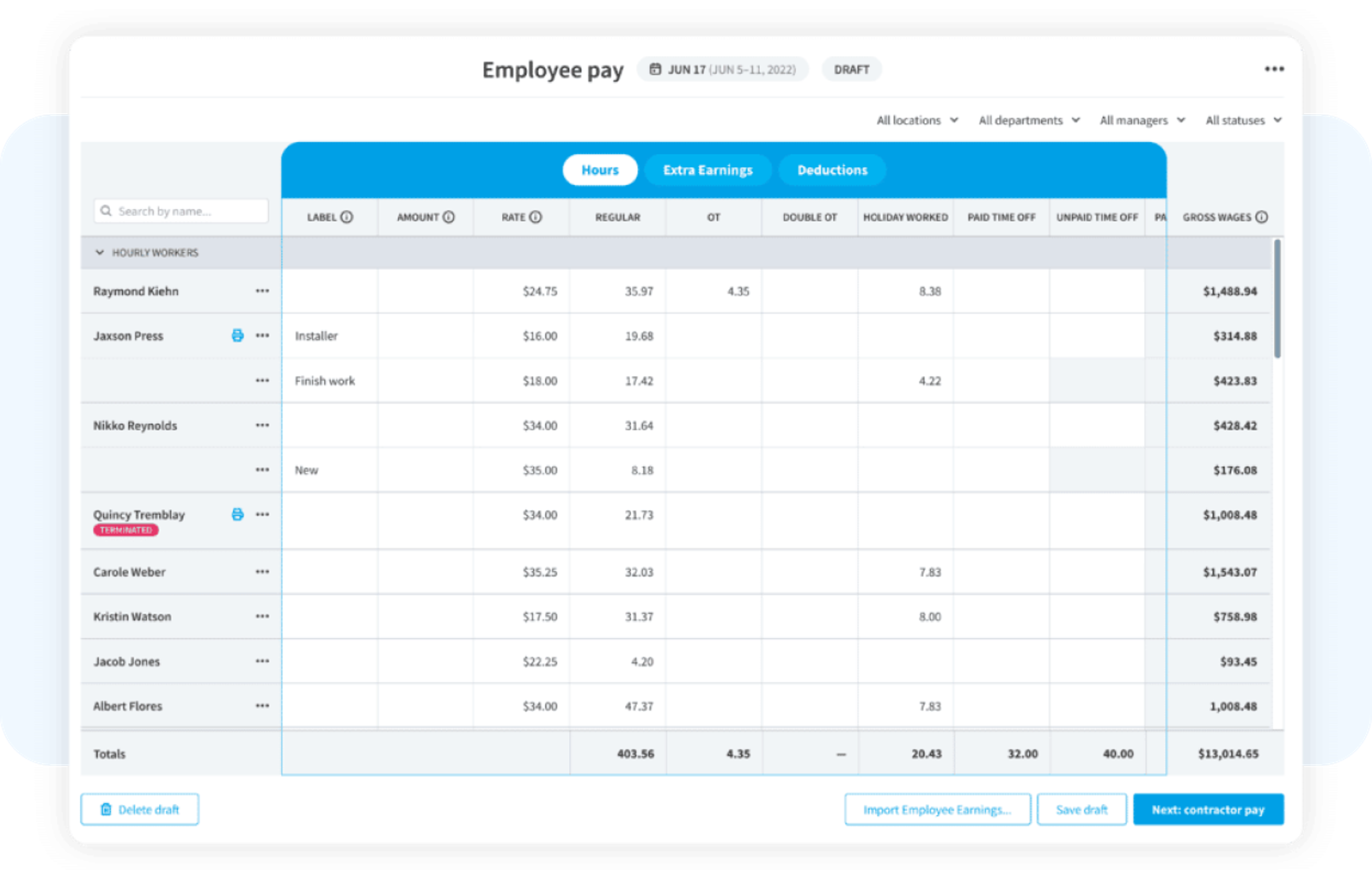

Verify pay info and make any adjustments you like

Our payroll processing software can be customized to connect seamlessly with your business. Minimize errors in payroll and taxes with Eddy.

- It’s quick and easy to add any other reimbursements, tips, bonuses, corrections or additions.

- If you use another tool for time tracking, it's simple to import those hours directly into Eddy.

- Let us manage your payroll by calculating and filing taxes, adding in withholdings for benefits, and adjusting additional deductions.

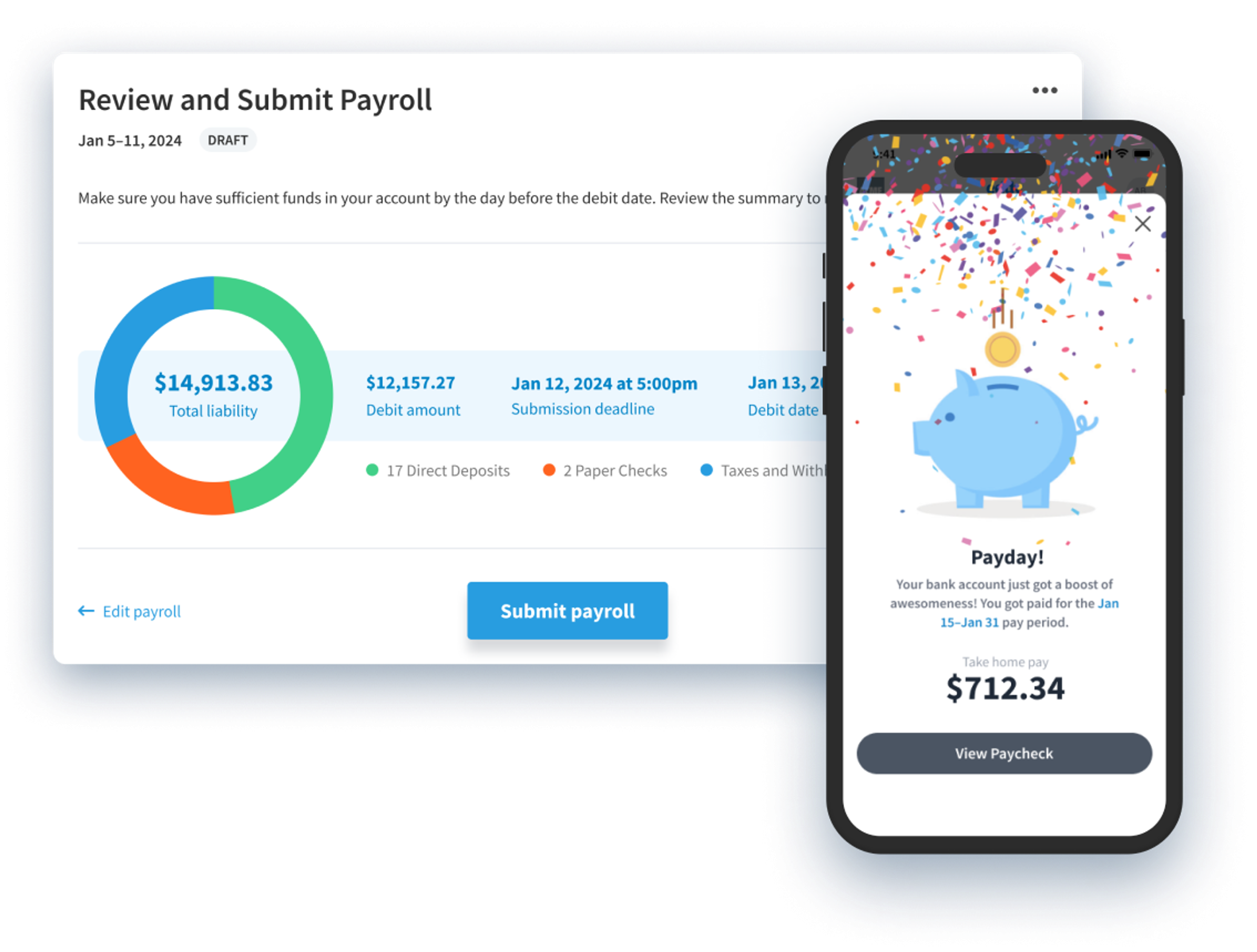

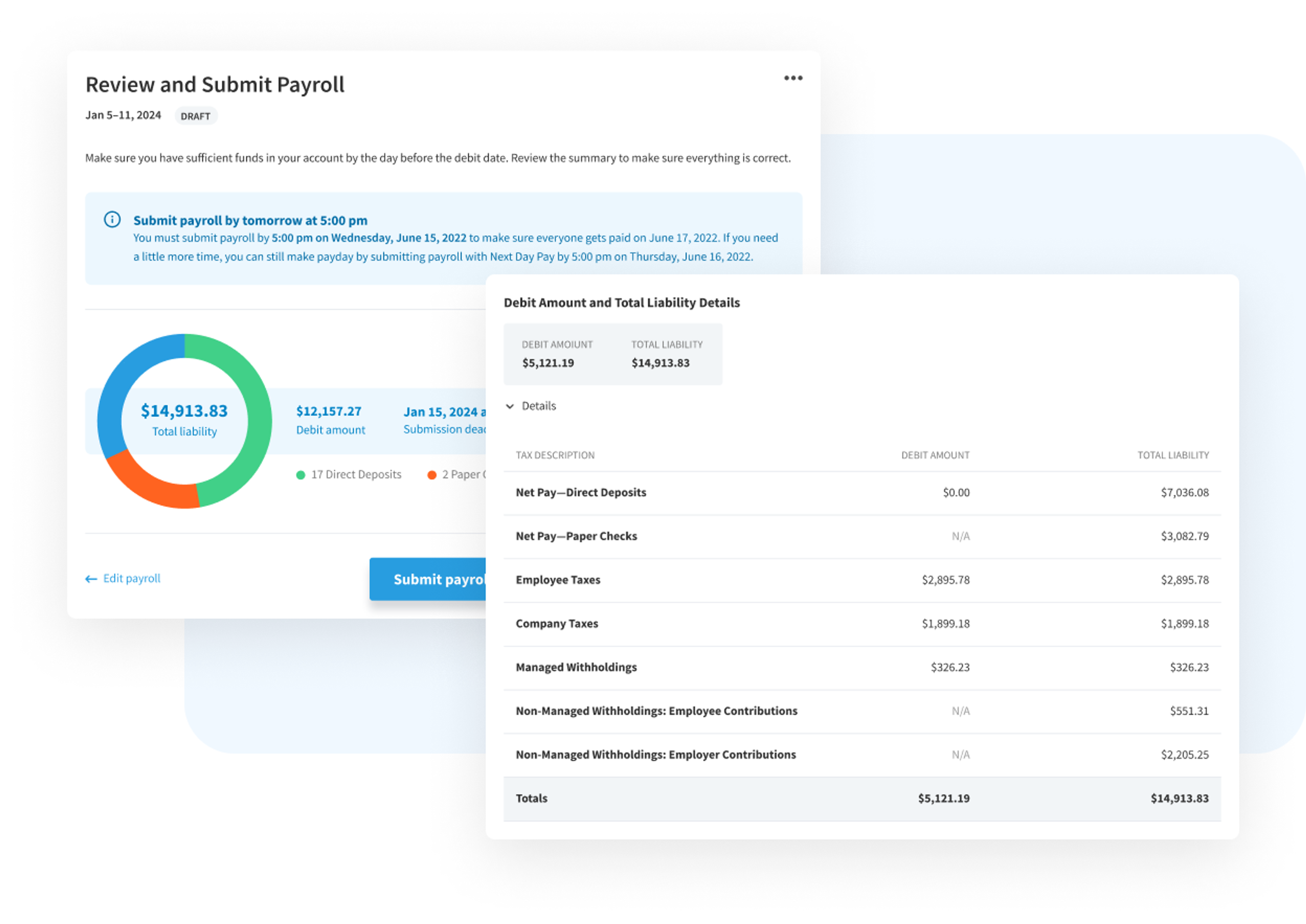

Review the simple summary and submit your payroll

Submit payroll as frequently as you need with just a few clicks. Our built in reminders make sure everyone gets paid on time, each time.

- Review employees earnings, taxes, and bank debits.

- After reviewing payroll, just hit submit—and you’re done! We handle the rest, including filing and sending your payroll taxes.

- Eddy supports unlimited payroll runs. Run as many payrolls as you need each month, including out-of-cycle payroll runs.

“I don't have time to work through complicated systems/programs.

Running payroll now takes me 5 minutes.”

Running payroll now takes me 5 minutes.”

Blake Beard

Head of HR, Xima

A better employee experience

Eddy makes HR + Payroll simpler for both you and your people.

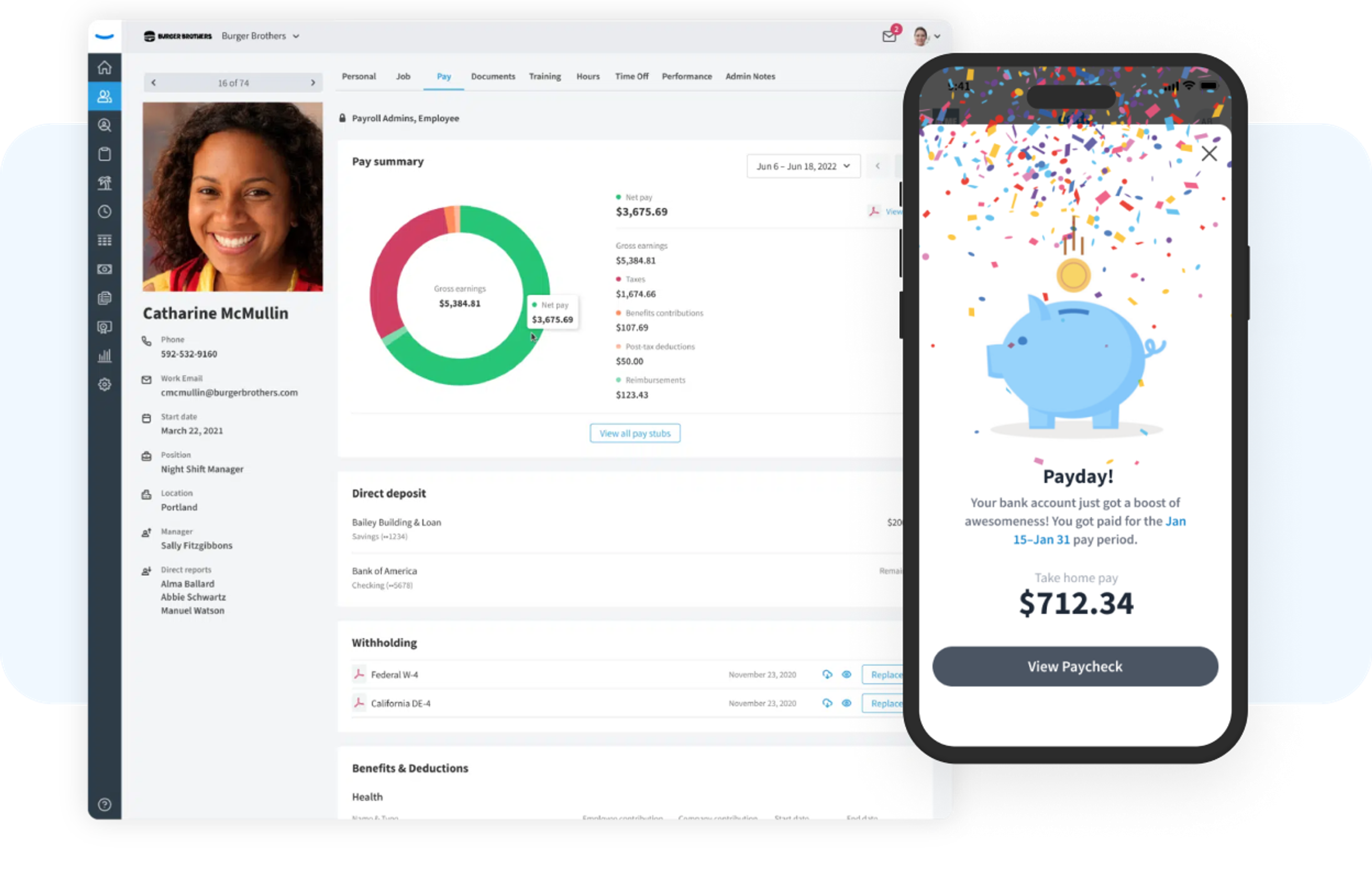

Easy Access to Pay Stubs and Tax Information

Managing payroll should be stress-free for both payroll admins and for employees. Eddy makes things simple for your people by giving everyone instant access to their pay stubs, benefits, and tax documents. Plus, employees can view and update direct deposit information and W-4 and state withholdings—all on the Eddy app or website.

Employees have access to their own payroll information

They can view pay stubs, benefits and deductions, and tax documents like W-2s and 1099 NECs. Plus, they can view and update direct deposit information and W-4 and state withholdings.

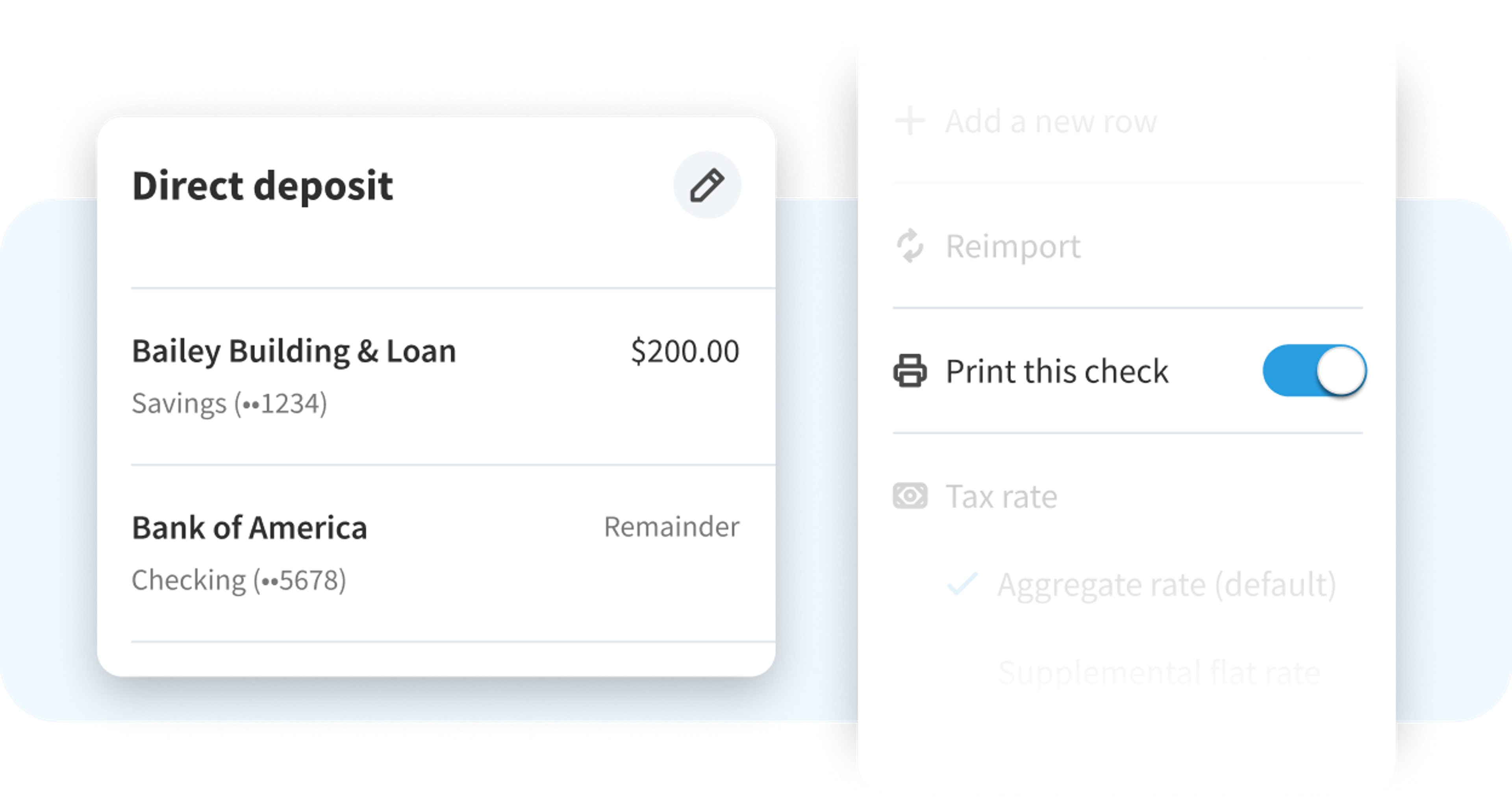

The flexibility of both direct deposit or paper check

Make payday more convenient for your employees. With direct deposit, pay is sent straight to an employee’s bank account, with the option to split their check into multiple accounts. Prefer to print and distribute your checks in-house? Download a PDF that can easily be printed on preprinted check stock.

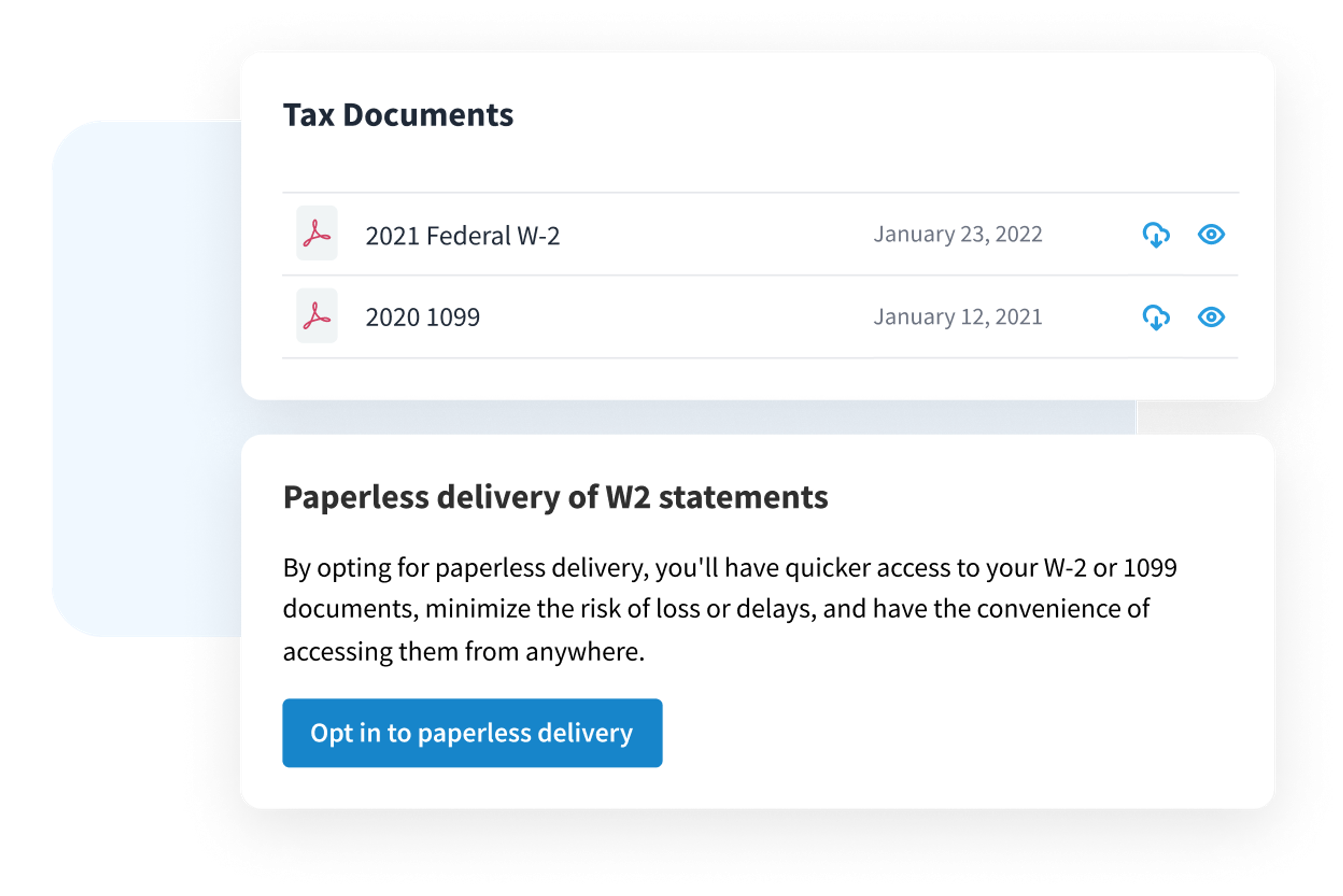

Timely end of year W-2 and 1099-NEC tax document distribution

Eddy handles end-of-year W-2 and 1099-NEC tax preparation and filing, so you’ll be able to distribute accurate and compliant tax documents to your employees on time, every time. All tax documents are also made available online for each employee or contractor to view.

“[Eddy] makes my life so much more simple. Other platform look almost like spreadsheets, and with Eddy it is kind of almost nice and delightful to be able to log in and see what's going on with my team.”

Lynda Bean

VP & Co-Founder, Bean Family Enterprises

Connect your benefits, 401(k), and more

Eddy’s HR and payroll management software seamlessly integrates from system-to-system to save you time and money.

Seamless integrations across platforms

- Eddy’s partnership with Employee Navigator means benefits data is always in sync. Benefits-related changes in either system flow back and forth automatically.

- With Guideline, employee 401(k) deductions are automatically added to payroll and remain updated as info changes.

- Next’s pay-as-you go workers compensation insurance is integrated with Eddy payroll.

“The cost savings [with Eddy] was almost immediate. Eddy is paying for itself.”

Bill McClain

President, Networking Solutions

Additional Tools to Simplify Your Life

With Eddy's all-in-one HR platform you can hire, onboard, manage, and pay employees with one easy-to-use system. No headache required.

Frequently asked questions

Why do our customers love Eddy?

We’ll let them tell you themselves.

"I enjoy the easiness of keeping track of everything."

I enjoy the easiness of keeping track of everything. We use it to clock in and out and keep track of hourly employees. My favorite part is the training portion that allows me to track license and liabliity insurance expirations with documentation. We use it to keep track of birthdays. It is especially helpful in onboarding and keeping track of new employees and their accrediations and required documents.

Angela M

2023-09-05

Small Business (50 or fewer employees)

“Eddy is amazing!”

Eddy is so great and extremely user friendly! It allows us to house everything in one place with very easy access for our staff. Also love that our applicant tracking is right there to just move over a candidate's information if they are hired.

Tara R.

2023-07-25

Mid-Market (51-1000 employees)

"Eddy - A streamlined HR Platform"

Eddy is such a great platform for our HR management. It has cut down a lot of monotonous tasks with recruiting and really streamlined the process. It also has increased visability for our team with documentation and tasks. We are so greatful to have Eddy as our HR platform!

Krystal D.

2023-08-01

Small Business (50 or fewer employees)

"Eddy has definitely made my life easier"

Eddy has definitely made my life easier through automatic tracking of training requirements for the hospital employees I help administer. They are a great alternative with a wonderful price point that was a fraction of the cost of some of the bigger, more well-known HRIS platforms.

I have a number of annual trainings that are required that used to require a large number of man hours to track individually for each employee in the organization. Thanks to Eddy, the process has become automated.

Jeffrey M.

2023-07-31

Mid-Market (51-1000 employees)

"All employee info in one place and at our fingertips."

Love the ability to have all employee info in one place—salary info, contact info, documents, HR notes, training docs, vacation/sick hours, hire date. Payroll process is really easy. It accommodates all types of extra pay situations and deduction situations. Support is prompt and very helpful.

Karen H.

2023-07-27

Small Business (50 or fewer employees)

"Since Eddy we have had nothing but smooth sailing!"

Eddy has made my work life a little easier! We recently changed payroll systems and were impressed with what we were shown. Transitioning to this system was sooo easy! It is very user friendly.

We were having a little trouble with time tracking before Eddy. Since Eddy we have had nothing but smooth sailing! Eddy is really simple in the best way!

Kayla T.

2023-08-03

Small Business (50 or fewer employees)

"I would highly recommend Eddy to anyone!"

Eddy is incredible! They have everything you need and more when it comes to an HRIS software. They have thought of everything and are constantly adding new features. Their support team is wonderful - we love Lauren! They are quick to respond and have all of the answers. I would highly recommend Eddy to anyone!

I don't have any complaints about Eddy. I enjoy their trainings, the software is amazing, their support team is on top of it. They are a great company.

Anonymous

2023-07-27

Small Business (50 or fewer employees)

See how Eddy can simplify your payroll

Experience our HR payroll software in a personalized demo.