Eddy Payroll Software

Eddy includes everything you need in an all-in-one HR Suite. You can hire, onboard, manage, and pay employees with one easy-to-use platform. No headache required.

Run payroll in minutes, not hours

Track everything you need in Eddy, then watch it magically appear in Payroll

Verify pay info and make any adjustments you like

Review and submit your payroll

Employees have access to their own payroll information

The flexibility of both direct deposit or paper check

Timely end of year W-2 and 1099-NEC tax document distribution

...and much more!

Trusted by small and midsize businesses worldwide

4.7 stars from 200+ reviews

The secret to easy payroll? A simple all-in-one HR and payroll platform.

The secret to easy payroll? A simple all-in-one HRMS payroll software

Eddy makes running payroll easy, quick, and stress-free by eliminating double entry, and by providing you with full-service tax filing, comprehensive payroll reporting, excellent employee experience, and superior customer support.

Run payroll in minutes, not hours

Eddy is the easiest way to run payroll for a small business because everything you need to run payroll—hours, time off, benefits, and more—flows automatically into payroll. Plus, we handle quarterly and annual tax filings and end-of-year W-2 and 1099-NEC preparation and filing. So no more mistakes from manual entry, and no more worries about not being compliant.

Your people will love Eddy Payroll with easy access their own pay stubs, benefits and deductions info, and tax documents like W-2s and 1099s.

Your people will love Eddy Payroll with easy access their own pay stubs, benefits and deductions info, and tax documents like W-2s and 1099s.

Track everything you need in Eddy, then watch it magically appear in Payroll

Manual data entry in another payroll system? Not with Eddy. Save those fingers for more important work.

- If you are using Eddy’s core HR tools, you already have all the data you need. At the end of the pay period, it all flows automatically right into Payroll.

- Eddy makes it easy to review and approve all hours worked and time off requests (you can even assign this task to managers), so hours are accurate when it’s time to run payroll.

Verify pay info and make any adjustments you like

Our payroll processing software can be customized to connect seamlessly with your business. Minimize errors in payroll and taxes with Eddy.

- It’s quick and easy to add any other reimbursements, tips, bonuses, corrections or additions.

- If you use another tool for time tracking, it's simple to import those hours directly into Eddy.

- Let us manage your payroll by calculating and filing taxes, adding in withholdings for benefits, and adjusting additional deductions.

Review the simple summary and submit your payroll

Submit payroll as frequently as you need with just a few clicks. Our built in reminders make sure everyone gets paid on time, each time.

- Review employees earnings, taxes, and bank debits.

- After reviewing payroll, just hit submit—and you’re done! We handle the rest, including filing and sending your payroll taxes.

- Eddy supports unlimited payroll runs. Run as many payrolls as you need each month, including out-of-cycle payroll runs.

See how Eddy can simplify your payroll

Schedule time for a customized demo.

Eddy's all-in-one HR + Payroll makes payroll easier

Eddy's all-in-one HR and payroll platform makes running payroll easy, quick, and stress-free by eliminating double entry, and by providing you with superior customer support and excellent employee experience, comprehensive payroll reporting, and full-service tax filing.

Have all your employee data at your fingertips

Store all your employee information in one secure database that you can access from anywhere.

- Important documents, like W-4s, I-9s, and any other signed employee files.

- Track all personal and contact info, including emergency contacts. Employees can even update their own info when it changes.

- Organize job info, like job title, pay rates and pay rate history, assigned assets, workers’ comp codes, performance notes, and more.

- Stay on top of employee certifications and trainings, storing things like proof of licenses and expiration dates.

“Eddy has made this simple for me. I'm not an HR person. There's enough hard things about building a new business. Having Eddy just really is a godsend because it is so easy. If only everything else would be this easy!”

Trebeca Itzen

Owner/Admin at Bighorn Plumbing

Find and hire the perfect candidates

Our HRIS helps you find the right candidates and start the interview process sooner.

- Improve recruitment by publishing job listings on up to 25,000 job boards with a few clicks.

- Avoid discriminatory job descriptions and qualifications with help from Eddy.

- Automated messaging and customizable pipelines make sure no candidates slip through the cracks.

- Track candidates throughout the hiring process for easy collaboration and decision making.

- Easily send an offer letter with custom templates provided by Eddy.

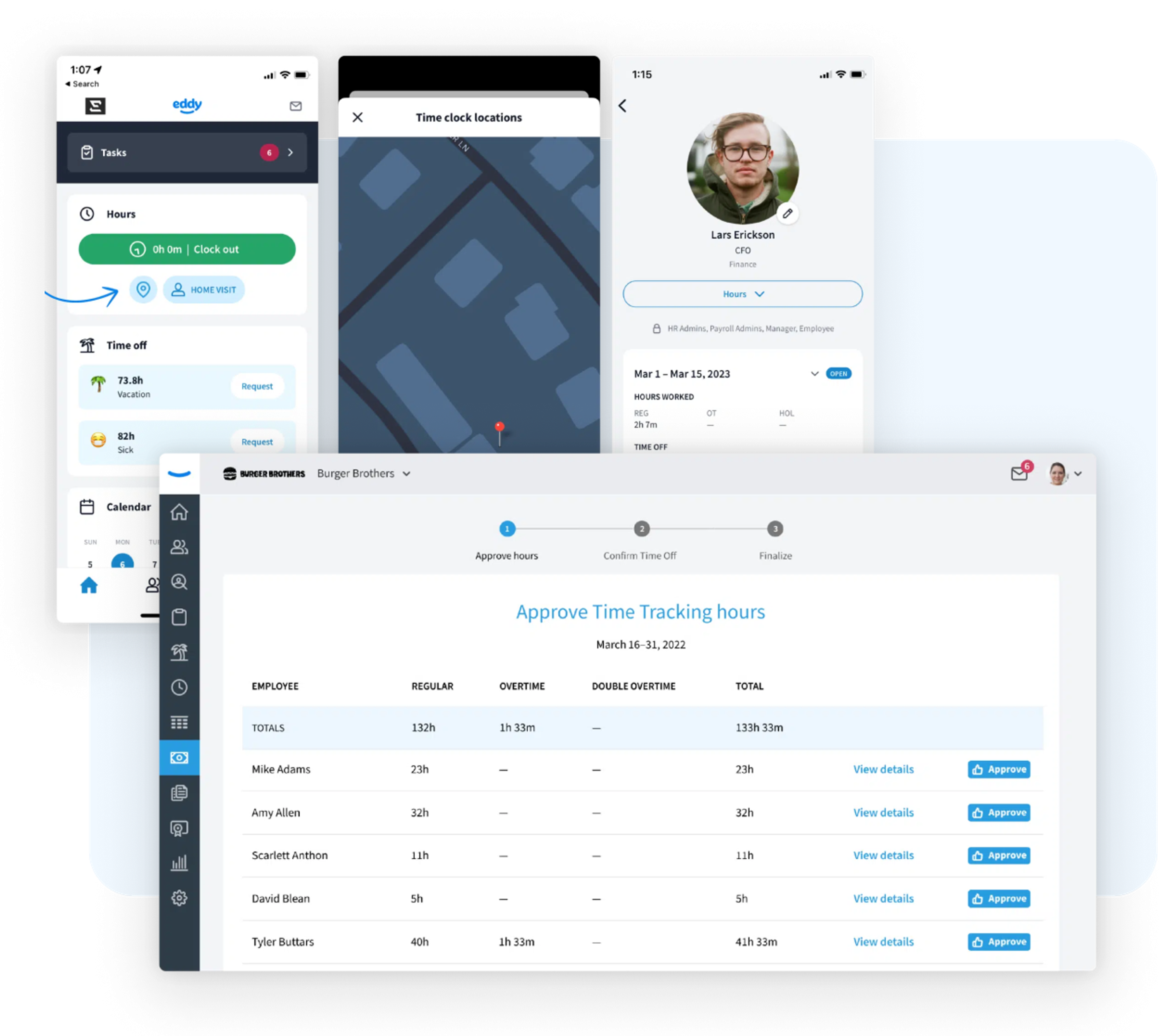

Track time easily and accurately

Simple time tracking tools make time sheets accurate every pay period.

- No wasting time entering hours twice: timesheets flow automatically into payroll

- Edit and approve employee timesheets in seconds

- Save time for everyone, from employee to manager to admin with our time and attendance management software

- Employees can easily and accurately track their hours with the Eddy mobile app

- Keep workers honest by geotagging each time punch

“Eddy is just overall just a better experience for our employees, which if you have happy employees, you have productive employees.”

Blake Beard

Head of HR, Xima

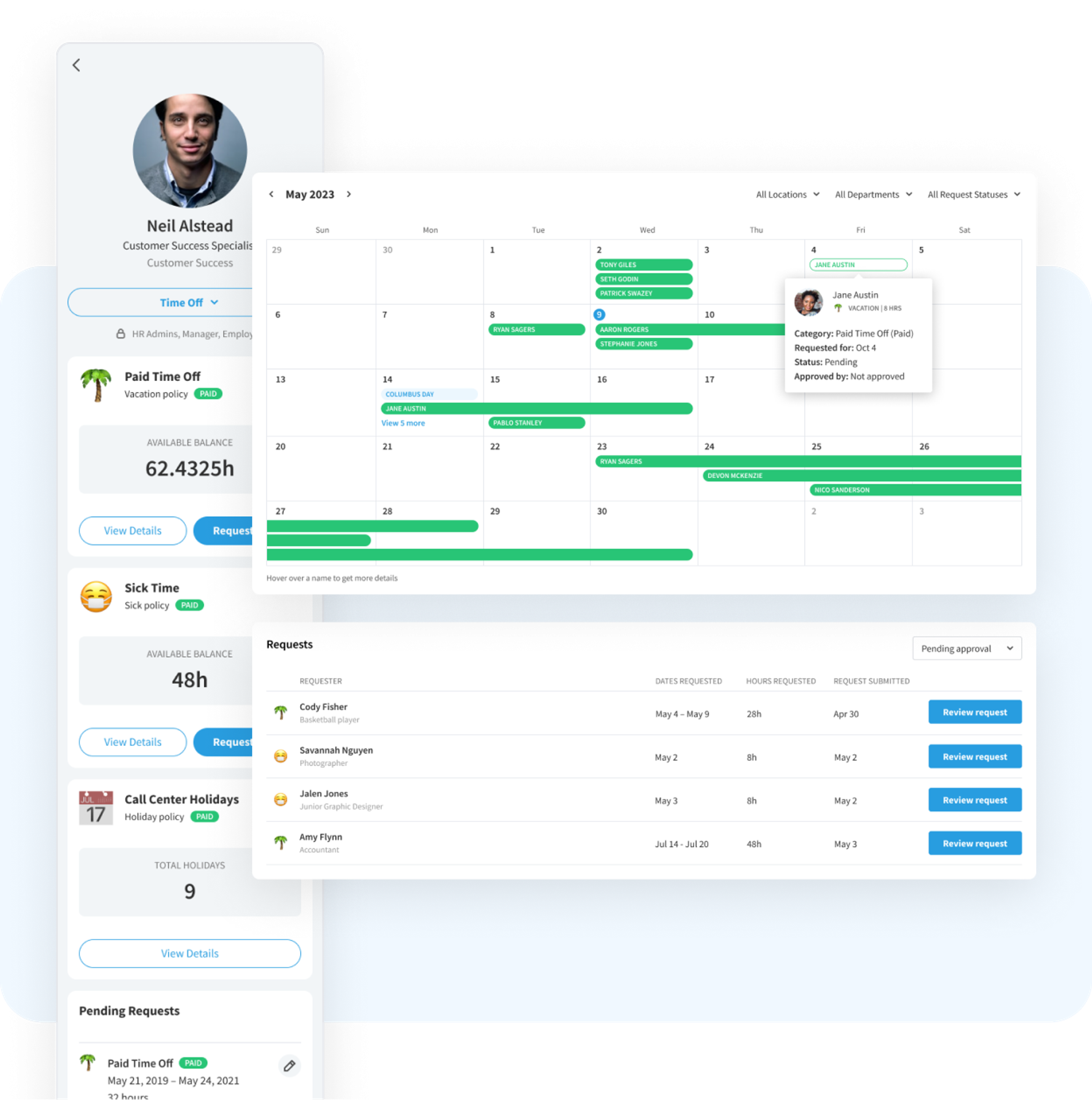

Streamline your PTO processes

Eddy makes sure time off hours are accurate, so you don’t have to. Holiday calendars help keep track of employees on vacation or sick leave.

- PTO requests and approvals happen seamlessly with our time off tracking software

- Create custom PTO Policies—as many as you need

- Employees can see their balances and request time off in the Eddy mobile app

Frequently asked questions

See how Eddy can simplify your payroll

Schedule time for a customized demo.