Eddy’s HR Mavericks Encyclopedia

The world's largest free encyclopedia of HR, with 700+ HR articles and podcasts.

Created by Eddy and our HR Mavericks community.

Payroll Software

Making sure employees get paid correctly and on time is one of the most important HR tasks. But it’s an extremely time-consuming process that takes HR professionals away from more strategic HR projects. Luckily, great payroll software can help. Below, we’ve listed our favorite payroll software along with some tips for how to choose the best payroll software for your company.

What Is Payroll Software?

Payroll software is a type of HR software that automates your payroll process. Well-designed payroll software will automate clerical tasks such as calculating hours worked, tracking overtime, calculating deductions for state and federal taxes, incorporating any paid time off and, of course, paying your employees. It will also provide support and resources for tax filings, workers’ compensation and other payroll related duties.

The Top Five Payroll Software of 2023

Looking for a new payroll software? We know it can be overwhelming. To help, we've made a list of our favorite payroll platforms.

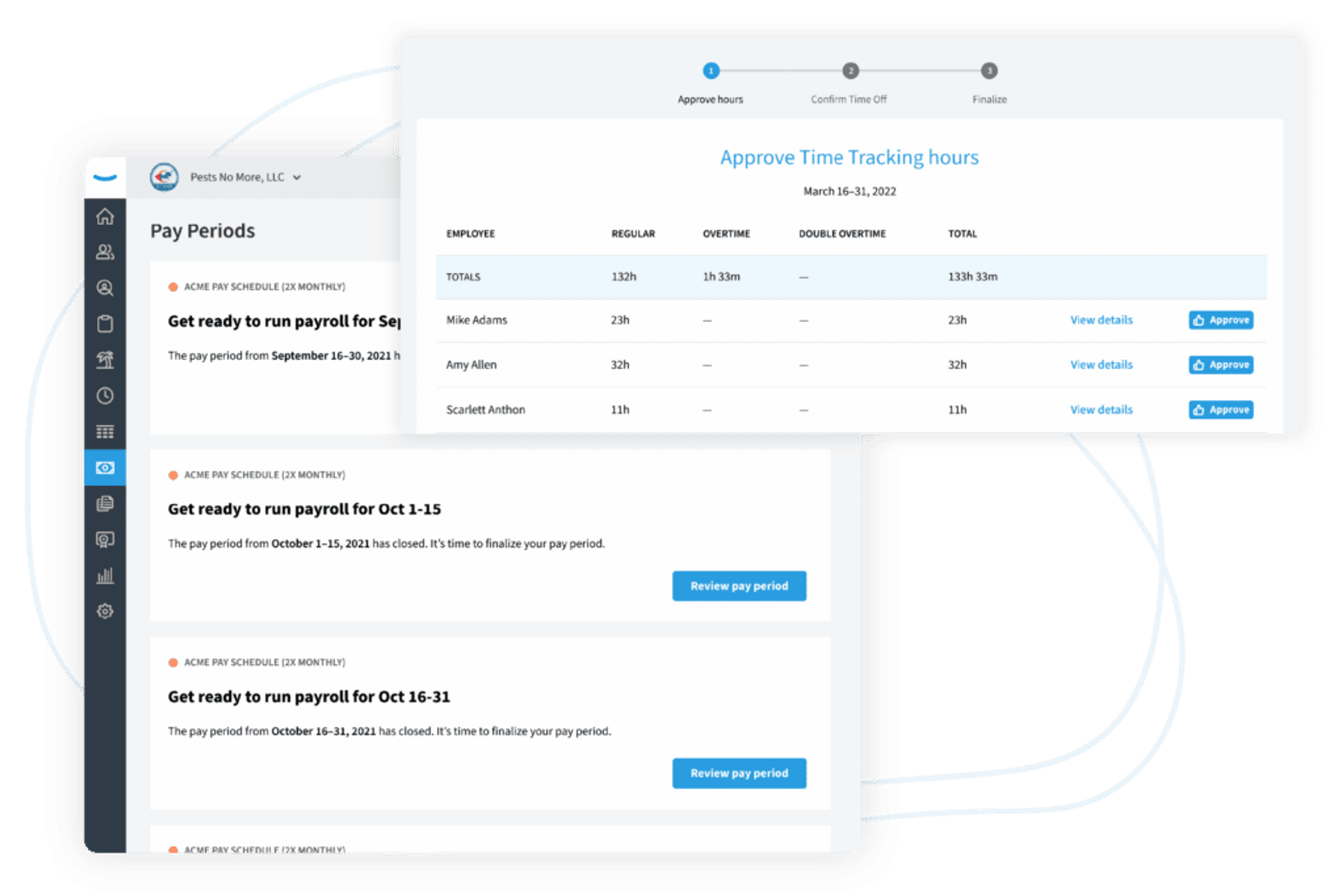

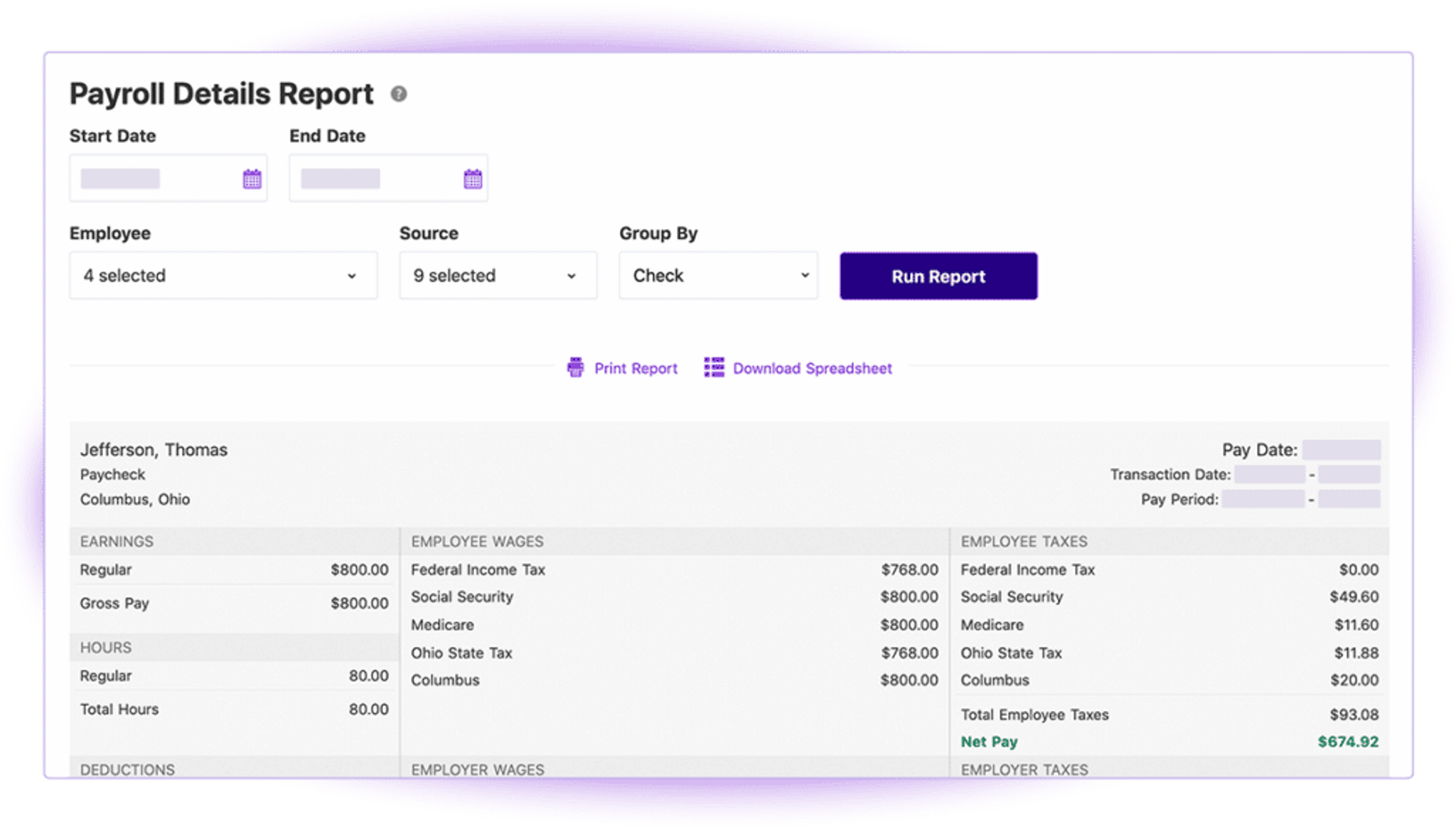

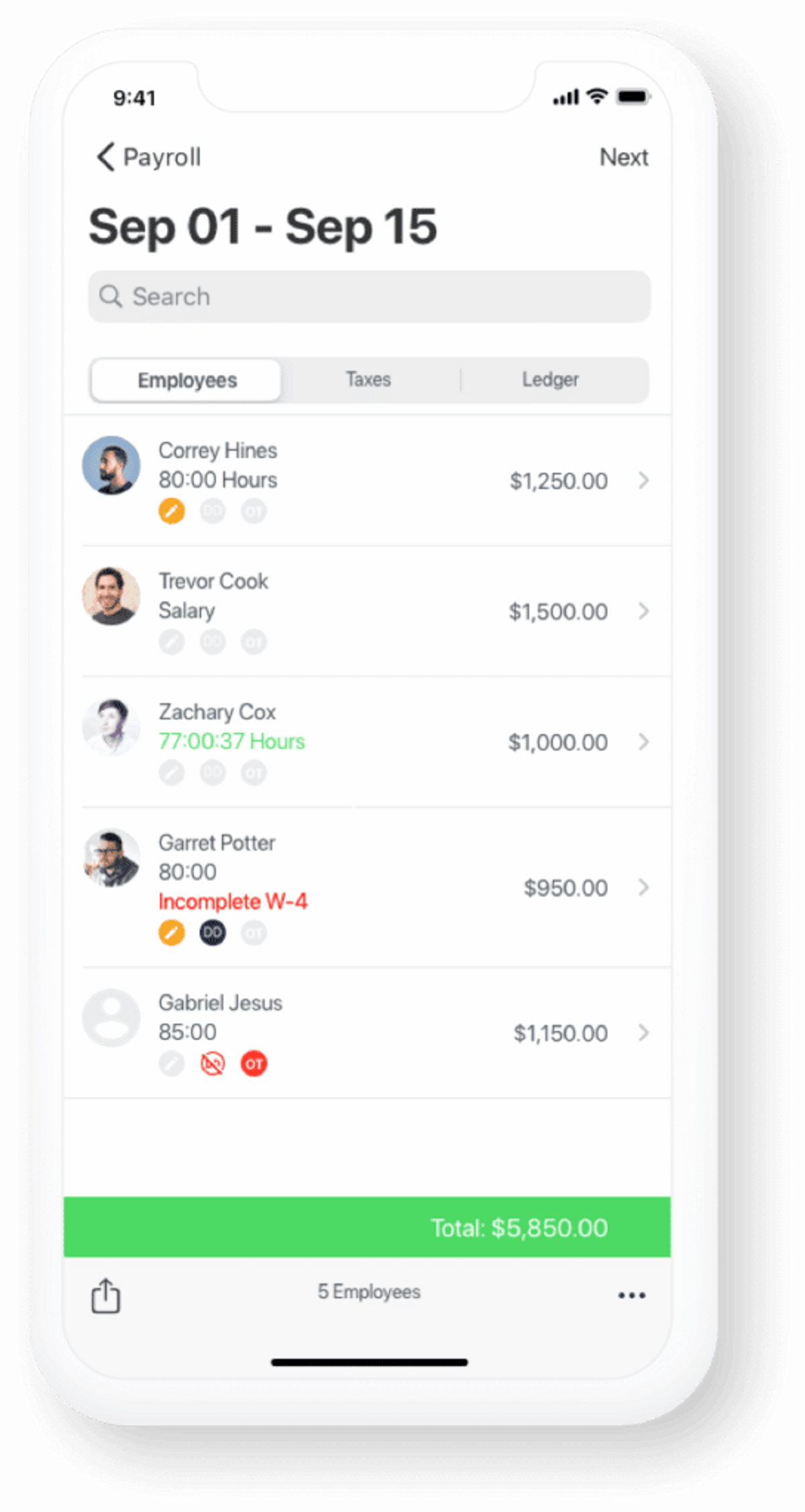

1. Eddy

Eddy HR is a full-service HR software company that provides recruitment, payroll and HR process solutions for small to medium-sized companies. Founded in 2017, Eddy HR has proven to be the top payroll software on the market, recently receiving the 2020 Top Vendor award by Shortlister for its payroll software.

Pros:

- Powerful, user-friendly, and intuitive

- Easy to learn, easy to teach

- Get support from a team of small-business payroll experts who take the time to get to know you

- Offers solutions for every aspect of HR management, including recruitment, timekeeping, people management, training, and more.

Pricing:

- Starts at $8 per person, per month

- Pricing depends on your company’s unique needs

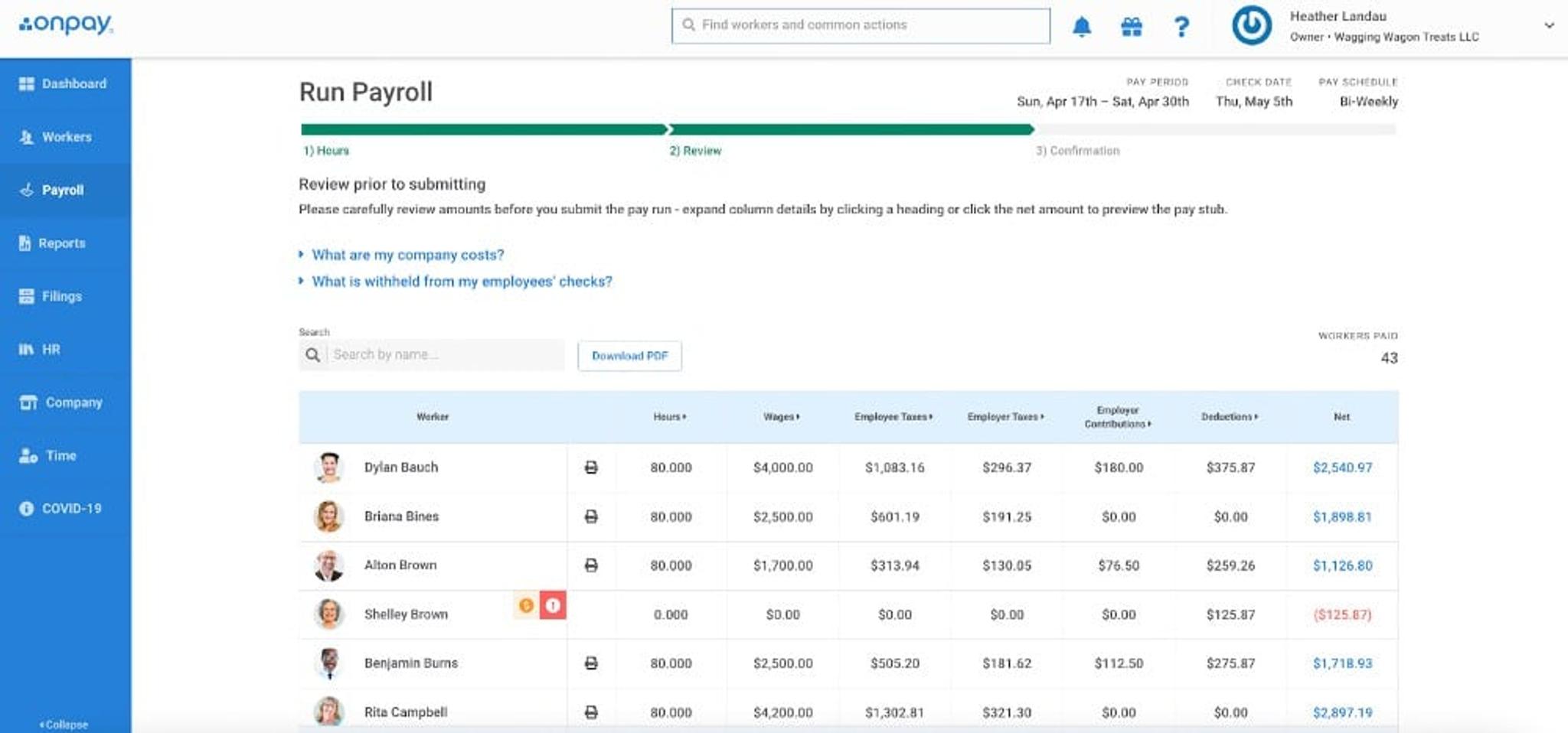

2. OnPay

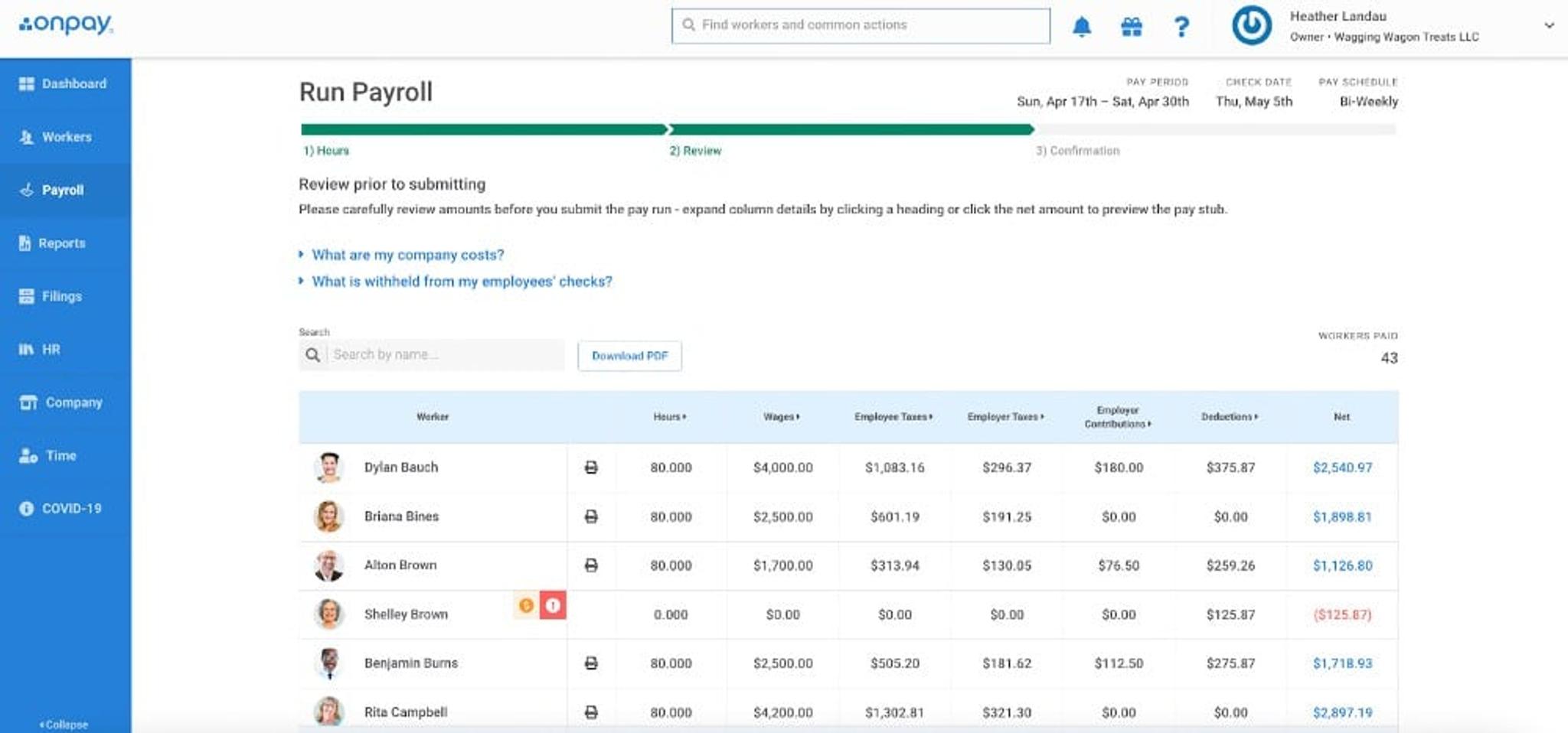

OnPay is an HR payroll software focused on helping small businesses with their payroll and tax filing needs. If you don’t need a full-service HR software solution, OnPay is a great option for your company. Because OnPay only provides payroll solutions, companies looking to purchase OnPay should first make sure it can integrate with their existing HR software. OnPay can integrate with QuickBooks, Xero and Vestwell, among others.

Pros:

- Easy to set up

- Relatively affordable for small businesses

- Employees can see their information in a self-serve portal

Pricing:

- Base price of $40 per month

- An additional $6 per person, per month

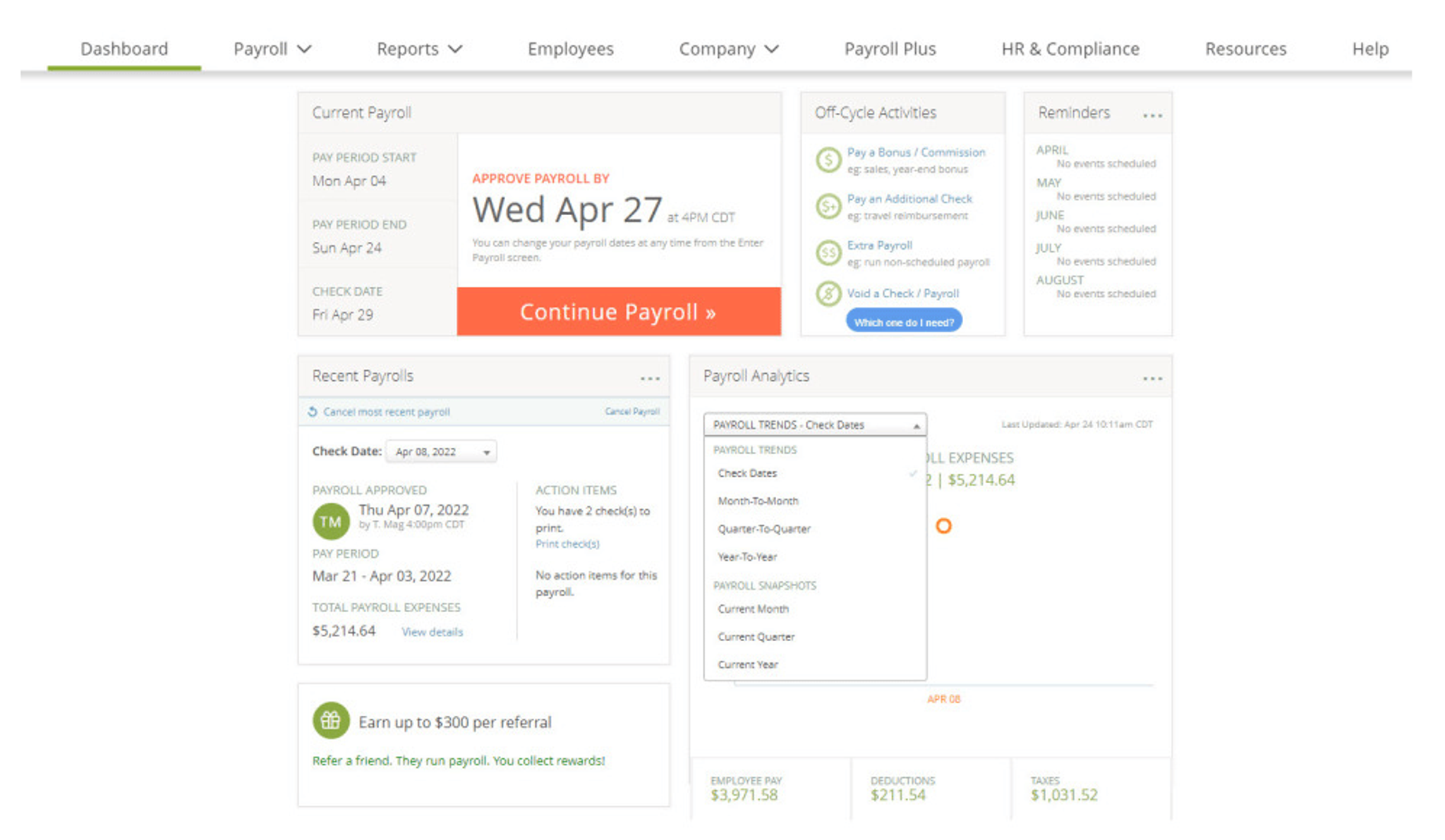

3. SurePayroll

SurePayroll is a simple payroll software for small and medium-sized businesses. It has been in business since 2000 and is responsible for creating the first completely online payroll and tax filing software solution for businesses with 1-100 employees.

Pros:

- Has more experience than any payroll software on the market

- Provides solutions for processes that often impact payroll, including workers’ compensation and health insurance

- User-friendly interface

Pricing information is available upon request.

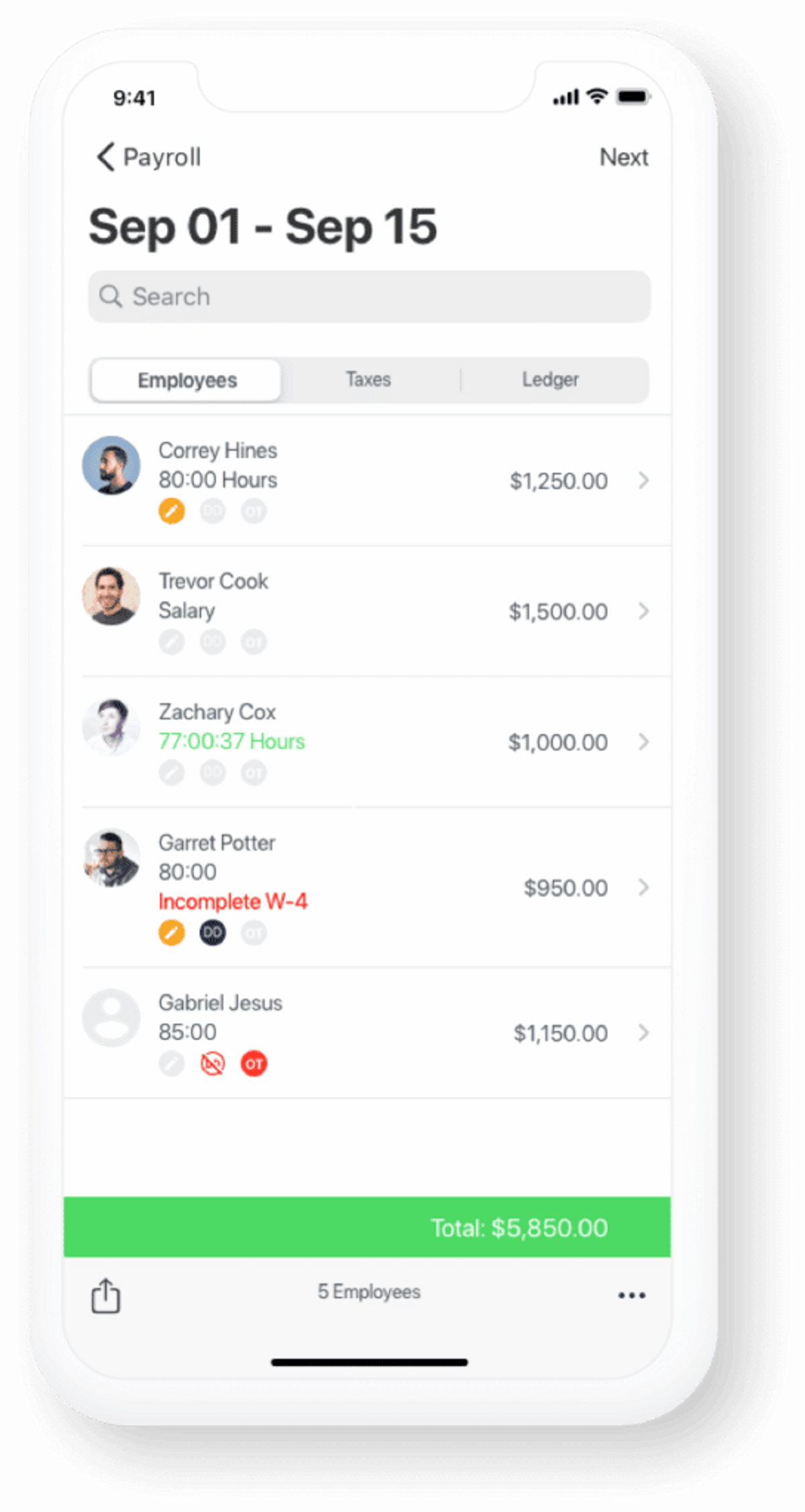

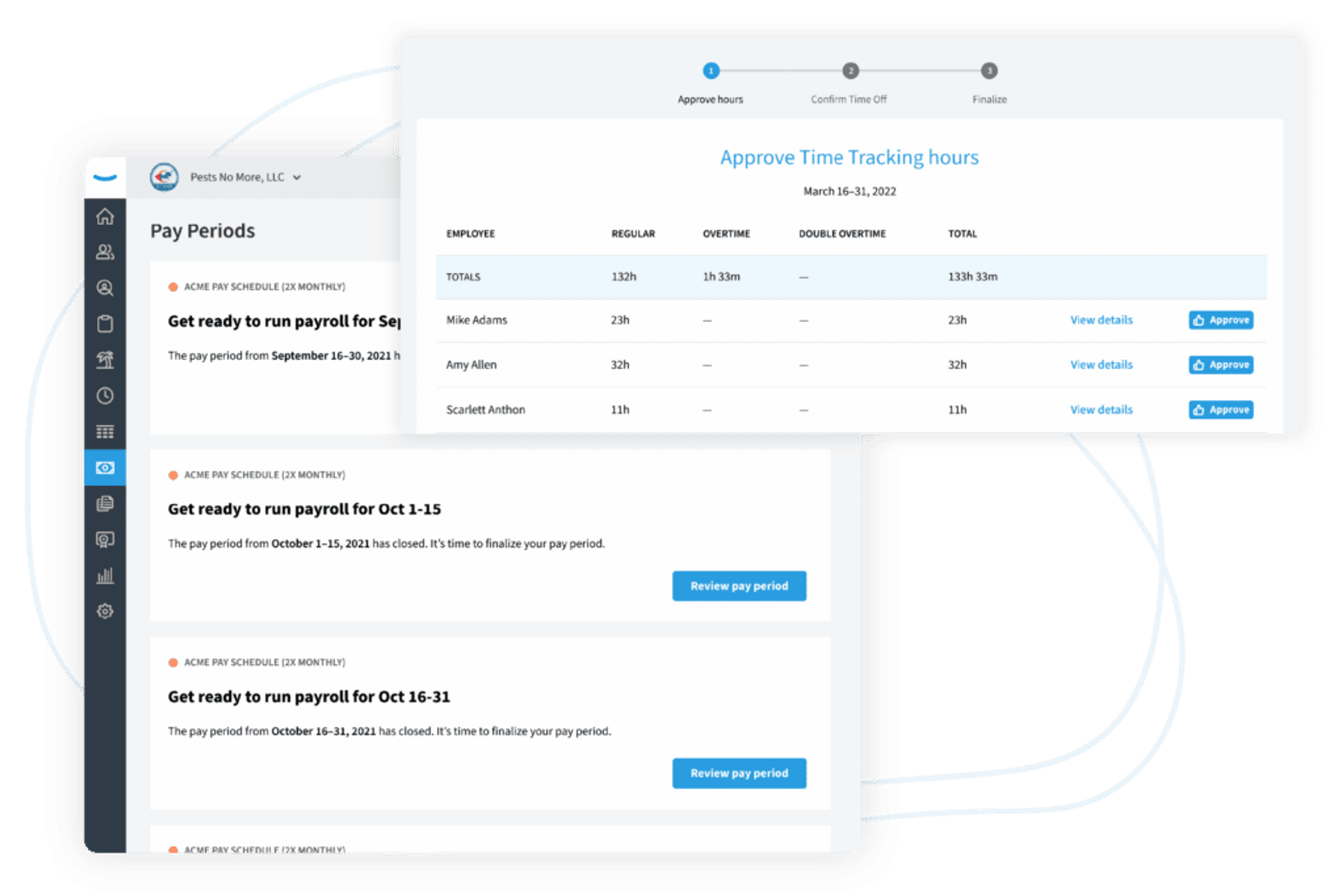

4. Hourly

Hourly is an HR payroll software company and also a workers’ compensation insurance provider. Hourly provides strong payroll solutions that will keep you compliant while also offering flexible pay-as-you-go workers’ compensation plans that are predictable and don’t have unnecessary fees.

Pros:

- Worker’s comp plan makes insurance costs more predictable and less complicated

- Has a mobile app option

- Built in time tracking feature keeps things running smoothly

Pricing:

- Gold: $40 per month, plus an additional $6 per person, per month

- Platinum: $60 per month, plus an additional $10 per person, per month

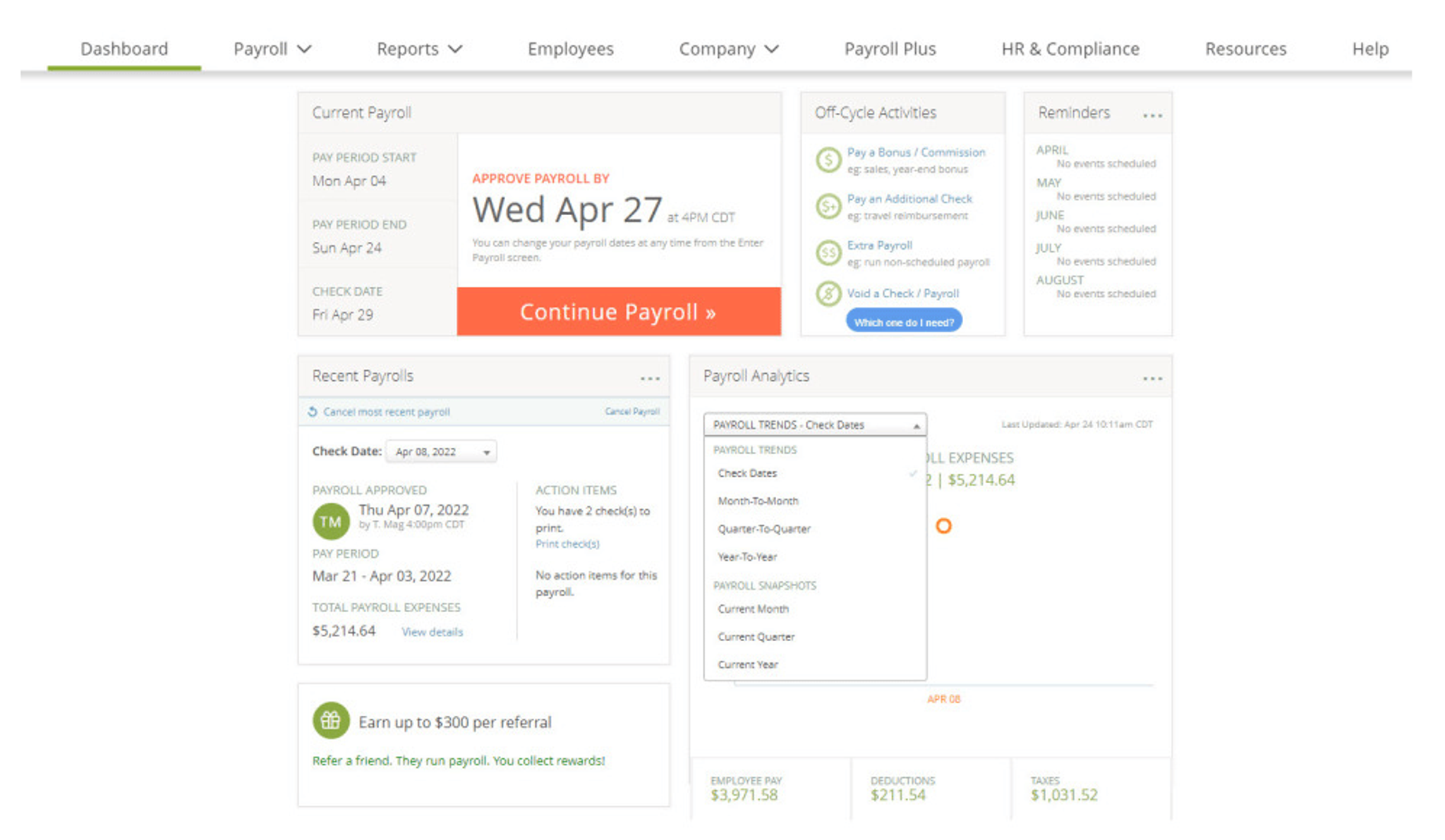

5. Patriot

Patriot is a payroll software for small businesses with plans that start at $10 a month. Their software is mobile-friendly, easy to set up and able to integrate with their time and attendance software and Quickbooks Time.

Pros:

- Affordable and mobile-friendly

- Customer support is helpful and responsive

- Makes payroll processing simple, even for those who don’t know much about payroll

Pricing:

- Basic: $17 per month, plus an additional $4 per employee, per month

- Full Service: $37 per month, plus an additional $4 per employee, per month

The Benefits of Using a Payroll Software

The best payroll software has many benefits. Some of the most important benefits for HR professionals include:

- Time. Time is extremely valuable for busy HR offices. HR payroll software saves hours of time by automatically calculating hours worked, payments, and deductions.

- Accuracy. Payroll software ensures accuracy by removing the possibility of human errors caused by manual entry.

- Legal Compliance. The best payroll software will help you ensure your payroll system and schedule is compliant with state and federal tax laws, workers’ compensation laws, and other pay related laws.

- Record-Keeping. Payroll software improves record-keeping by creating a centralized location for important compensation and tax related records.

What Great Payroll Software Looks Like

Great payroll software should have certain features and capabilities. Below are some of the most important things you should look for in a payroll software.

Payroll Processing and Integration

Every payroll software must be able to process payroll. Good HR payroll software will integrate with other software, like timekeeping software, so that payroll can be processed smoothly. Luckily, some payroll software (like Eddy HR’s payroll software) can be included as a part of a full-service HR software. This makes integration unnecessary.

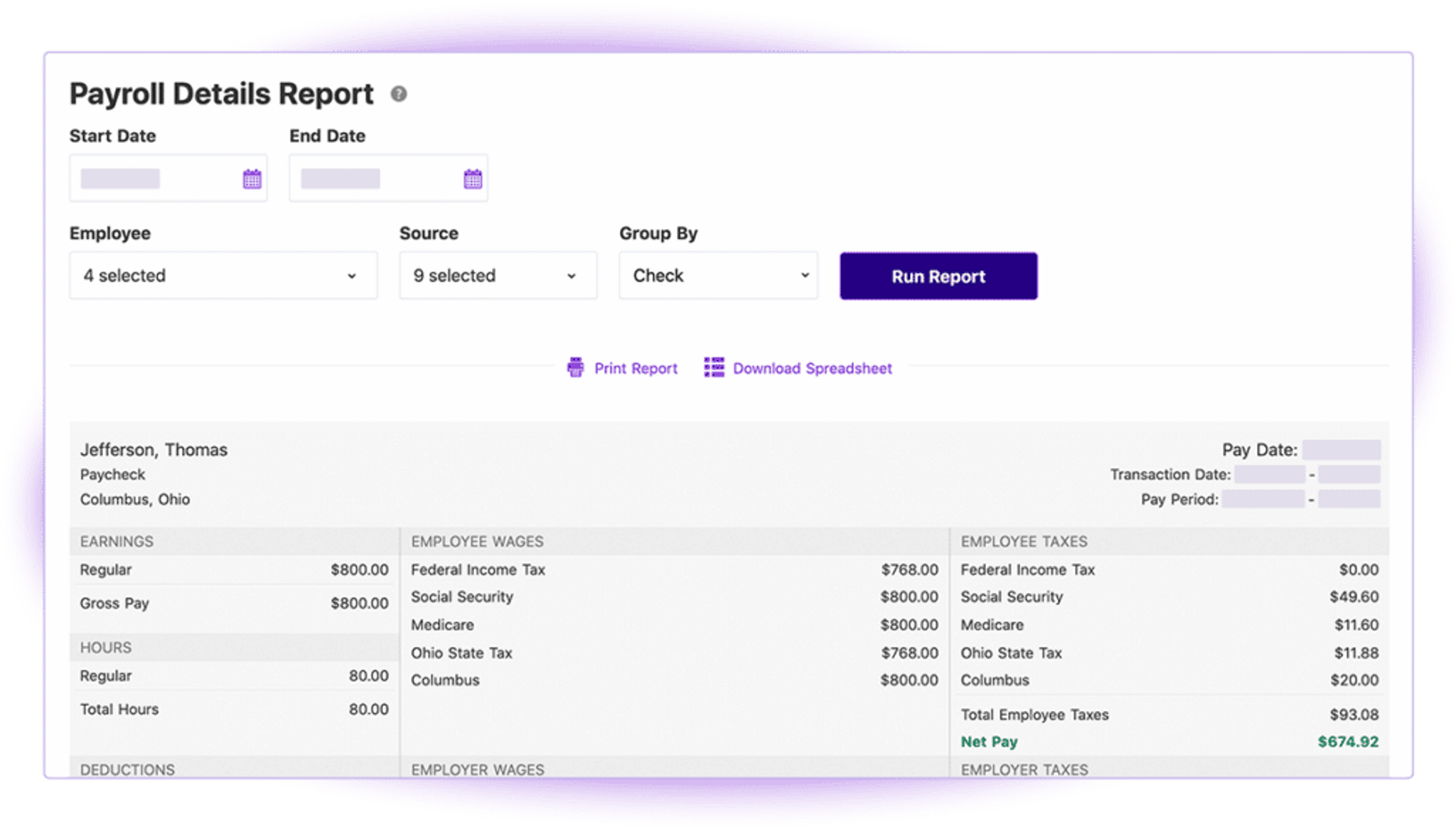

Tax Filing

Businesses have to keep track of their own taxes and tax deductions for their employees. The best payroll software system will calculate appropriate state and federal tax deductions and have tax filing capabilities. It should also provide you with pre-filled tax forms, like W-2, W-4 or 1099 forms.

Direct Deposit

Regardless of the size of your company, your payroll software should have direct deposit capabilities. Since it’s an automated process, direct deposit will ensure that your employees are paid on time. You also won’t have to invest company resources in printing and issuing checks.

User-Friendly Employee Self-Service Interface

A common complaint that all HR offices receive from employees is that the self-service portal is too complicated or difficult to navigate. The best payroll software should have an intuitive, user-friendly self-service portal to help employees complete tasks, like reporting their sick leave or changing their home address.

Reporting Features

Great payroll software will be able to provide you with customized reports to help you and other stakeholders analyze and understand payroll and benefits data. Solid reporting capabilities can help you identify trends, understand your costs and budget, and set goals for the future. Learn more about people analytics here

How to Pick the Software that’s Right for You

There are countless payroll software companies available online. Although many of them are good solutions, the best payroll software for one company may not be the right software for you. Which payroll software is best for you will depend on your payroll needs, whether you will integrate your software with other software and your budget.

1. Determine Your Payroll Needs

How many employees do you have? Are they paid by the hour? Are they seasonal? Do you sub-contract? Do you have employees abroad? Answer these questions to determine what your payroll needs are. Understanding your needs will help you determine which software is best for you and which pricing structure is best based on your company size.

2. Consider Integration Capabilities

When it comes to HR software, you can either invest in a full-service software that has everything you need or you can invest in multiple software providers. For example, our software Eddy is an all-in-one HR solution If you decide to use more than one software provider, it’s extremely important that you confirm your new software can integrate with any new software. If one of your software solutions can’t integrate, you will lose hours of work having to manually enter data.

3. Choose Your Budget

Before choosing a payroll software solution, you’ll have to determine how much you can invest. When considering your budget, remember that pricing for most payroll software is based on how many employees your company has. A realistic budget has to match your workforce. Otherwise, you’ll end up with a software that doesn’t do what you need it to do.

Topics

Natasha Wiebusch

Natasha is a writer and former labor and employment attorney turned HR professional. Her experience as a litigator and HR trainer inspired her to begin writing about anti-discrimination laws in the workplace. As a writer at Eddy HR, she hopes to provide helpful information to both employees and HR professionals who need help navigating the vast world of human resources. When she's not writing, you might find her cheering on the Green Bay Packers or hiking in the Northwoods of Wisconsin.

Frequently asked questions

Other Related Terms

Eddy’s HR Mavericks Encyclopedia

Payroll Software

Making sure employees get paid correctly and on time is one of the most important HR tasks. But it’s an extremely time-consuming process that takes HR professionals away from more strategic HR projects. Luckily, great payroll software can help. Below, we’ve listed our favorite payroll software along with some tips for how to choose the best payroll software for your company.

What Is Payroll Software?

Payroll software is a type of HR software that automates your payroll process. Well-designed payroll software will automate clerical tasks such as calculating hours worked, tracking overtime, calculating deductions for state and federal taxes, incorporating any paid time off and, of course, paying your employees. It will also provide support and resources for tax filings, workers’ compensation and other payroll related duties.

The Top Five Payroll Software of 2023

Looking for a new payroll software? We know it can be overwhelming. To help, we've made a list of our favorite payroll platforms.

1. Eddy

Eddy HR is a full-service HR software company that provides recruitment, payroll and HR process solutions for small to medium-sized companies. Founded in 2017, Eddy HR has proven to be the top payroll software on the market, recently receiving the 2020 Top Vendor award by Shortlister for its payroll software.

Pros:

- Powerful, user-friendly, and intuitive

- Easy to learn, easy to teach

- Get support from a team of small-business payroll experts who take the time to get to know you

- Offers solutions for every aspect of HR management, including recruitment, timekeeping, people management, training, and more.

Pricing:

- Starts at $8 per person, per month

- Pricing depends on your company’s unique needs

2. OnPay

OnPay is an HR payroll software focused on helping small businesses with their payroll and tax filing needs. If you don’t need a full-service HR software solution, OnPay is a great option for your company. Because OnPay only provides payroll solutions, companies looking to purchase OnPay should first make sure it can integrate with their existing HR software. OnPay can integrate with QuickBooks, Xero and Vestwell, among others.

Pros:

- Easy to set up

- Relatively affordable for small businesses

- Employees can see their information in a self-serve portal

Pricing:

- Base price of $40 per month

- An additional $6 per person, per month

3. SurePayroll

SurePayroll is a simple payroll software for small and medium-sized businesses. It has been in business since 2000 and is responsible for creating the first completely online payroll and tax filing software solution for businesses with 1-100 employees.

Pros:

- Has more experience than any payroll software on the market

- Provides solutions for processes that often impact payroll, including workers’ compensation and health insurance

- User-friendly interface

Pricing information is available upon request.

4. Hourly

Hourly is an HR payroll software company and also a workers’ compensation insurance provider. Hourly provides strong payroll solutions that will keep you compliant while also offering flexible pay-as-you-go workers’ compensation plans that are predictable and don’t have unnecessary fees.

Pros:

- Worker’s comp plan makes insurance costs more predictable and less complicated

- Has a mobile app option

- Built in time tracking feature keeps things running smoothly

Pricing:

- Gold: $40 per month, plus an additional $6 per person, per month

- Platinum: $60 per month, plus an additional $10 per person, per month

5. Patriot

Patriot is a payroll software for small businesses with plans that start at $10 a month. Their software is mobile-friendly, easy to set up and able to integrate with their time and attendance software and Quickbooks Time.

Pros:

- Affordable and mobile-friendly

- Customer support is helpful and responsive

- Makes payroll processing simple, even for those who don’t know much about payroll

Pricing:

- Basic: $17 per month, plus an additional $4 per employee, per month

- Full Service: $37 per month, plus an additional $4 per employee, per month

The Benefits of Using a Payroll Software

The best payroll software has many benefits. Some of the most important benefits for HR professionals include:

- Time. Time is extremely valuable for busy HR offices. HR payroll software saves hours of time by automatically calculating hours worked, payments, and deductions.

- Accuracy. Payroll software ensures accuracy by removing the possibility of human errors caused by manual entry.

- Legal Compliance. The best payroll software will help you ensure your payroll system and schedule is compliant with state and federal tax laws, workers’ compensation laws, and other pay related laws.

- Record-Keeping. Payroll software improves record-keeping by creating a centralized location for important compensation and tax related records.

What Great Payroll Software Looks Like

Great payroll software should have certain features and capabilities. Below are some of the most important things you should look for in a payroll software.

Payroll Processing and Integration

Every payroll software must be able to process payroll. Good HR payroll software will integrate with other software, like timekeeping software, so that payroll can be processed smoothly. Luckily, some payroll software (like Eddy HR’s payroll software) can be included as a part of a full-service HR software. This makes integration unnecessary.

Tax Filing

Businesses have to keep track of their own taxes and tax deductions for their employees. The best payroll software system will calculate appropriate state and federal tax deductions and have tax filing capabilities. It should also provide you with pre-filled tax forms, like W-2, W-4 or 1099 forms.

Direct Deposit

Regardless of the size of your company, your payroll software should have direct deposit capabilities. Since it’s an automated process, direct deposit will ensure that your employees are paid on time. You also won’t have to invest company resources in printing and issuing checks.

User-Friendly Employee Self-Service Interface

A common complaint that all HR offices receive from employees is that the self-service portal is too complicated or difficult to navigate. The best payroll software should have an intuitive, user-friendly self-service portal to help employees complete tasks, like reporting their sick leave or changing their home address.

Reporting Features

Great payroll software will be able to provide you with customized reports to help you and other stakeholders analyze and understand payroll and benefits data. Solid reporting capabilities can help you identify trends, understand your costs and budget, and set goals for the future. Learn more about people analytics here

How to Pick the Software that’s Right for You

There are countless payroll software companies available online. Although many of them are good solutions, the best payroll software for one company may not be the right software for you. Which payroll software is best for you will depend on your payroll needs, whether you will integrate your software with other software and your budget.

1. Determine Your Payroll Needs

How many employees do you have? Are they paid by the hour? Are they seasonal? Do you sub-contract? Do you have employees abroad? Answer these questions to determine what your payroll needs are. Understanding your needs will help you determine which software is best for you and which pricing structure is best based on your company size.

2. Consider Integration Capabilities

When it comes to HR software, you can either invest in a full-service software that has everything you need or you can invest in multiple software providers. For example, our software Eddy is an all-in-one HR solution If you decide to use more than one software provider, it’s extremely important that you confirm your new software can integrate with any new software. If one of your software solutions can’t integrate, you will lose hours of work having to manually enter data.

3. Choose Your Budget

Before choosing a payroll software solution, you’ll have to determine how much you can invest. When considering your budget, remember that pricing for most payroll software is based on how many employees your company has. A realistic budget has to match your workforce. Otherwise, you’ll end up with a software that doesn’t do what you need it to do.

Topics

Natasha Wiebusch

Natasha is a writer and former labor and employment attorney turned HR professional. Her experience as a litigator and HR trainer inspired her to begin writing about anti-discrimination laws in the workplace. As a writer at Eddy HR, she hopes to provide helpful information to both employees and HR professionals who need help navigating the vast world of human resources. When she's not writing, you might find her cheering on the Green Bay Packers or hiking in the Northwoods of Wisconsin.

Frequently asked questions

Other Related Terms

Eddy's HR Newsletter

Sign up for our email newsletter for helpful HR advice and ideas.