Eddy’s HR Mavericks Encyclopedia

The world's largest free encyclopedia of HR, with 700+ HR articles and podcasts.

Created by Eddy and our HR Mavericks community.

PTO Accrual

Is an accrual PTO plan right for you? In an age of increasing employee benefits driven by a competitive job industry, choosing the right paid time off plan is critical to attracting and retaining top talent. In this article, you’ll learn about accrual PTO plans and how you can implement one in your company!

What Is PTO Accrual?

Paid time off (or PTO) is one of the many benefits employers may offer to employees. Although PTO is not required by federal law, giving employees some time away from work has been proven to be overwhelmingly positive for both the worker and the company. In fact, over 73% of businesses offer PTO to their employees, and the average employee takes around 10 days off work each year. PTO accrual, or accrued PTO, is the type of PTO that employees can earn over time. It is often treated like a vested benefit or “bank account” for time off, where PTO days are earned, saved and spent like money would be with a bank account. In some cases, employees can even cash out their unused PTO days when they leave the company. PTO accrual plans often include maximum balances, where employees cannot accrue over a certain amount each year or during their tenure at the company.

Lump Sum vs Accrued PTO

With accruing PTO, employees will earn PTO per a certain period of time throughout the year (chosen by the employer). Employees will be able to save that PTO for another year, instead of having it expire annually like with use-it-or-lose-it PTO policies. Using the lump sum method, employees are given a set number of PTO days each year. They receive all their days at once, and at the end of the year, the days either roll over to the next year or expire. With lump sums, employees often receive more PTO days when they hit an important milestone; for example, when they reach 5 years at the company, they might receive additional PTO.

Is an Accrual Policy Right for Your Company?

As with every benefit your company implements, it’s important to consider what experience and culture you are trying to foster at your company. Here are some reasons why an accrual PTO policy might be right for your company:

- Your employees don’t currently have PTO. An accrual PTO plan is very standard across most industries and is a great place to start when setting up a PTO plan for your company.

- You don’t want your employees’ PTO to expire. Accrual PTO plans are a great option if you don’t want your employees’ PTO to expire.

- You want employees to own their PTO. Because accrued PTO does not expire like use-it-or-lose-it PTO, employees feel a sense of ownership over their PTO.

- Your company is financially ready. You feel that your company is ready for any financial implications or payouts associated with accrued PTO. Some states require that unused PTO is paid out to the employee when they leave the company.

How to Implement PTO Accrual

While there is no set way to set up a PTO accrual policy for your company, here is a general guide to help you get started:

Step 1: Consider Why and for Whom You Are Adding a PTO Policy

Before writing your policy, consider why you are looking to create a PTO policy in general and why you want it to be an accrual policy instead of a use-it-or-lose-it policy. What work culture are you trying to foster at your company and how does an accrual PTO policy contribute to that? Also consider which employees will be added to the PTO policy (i.e., full-time, part-time, exempt, nonexempt employees).

Step 2: Consider Legal Requirements And Potential Budgetary Costs for Payout

Take a look at the labor and PTO laws of the state(s) where you have employees. When drafting your PTO policy, you’ll need to consider what the requirements are for each state where you have employees. Some states may require a cash payout of PTO when an employee leaves the company. If this is the case in your state, you may want to consider the budgetary implications of such an accrual PTO policy.

Step 3: Decide the Details of Your PTO Policy

When figuring out the details of your company's PTO accrual policy, there are several key factors to take into consideration: Accrual Frequency. When creating your PTO plan, you’ll first want to ask yourself about the accrual frequency. We’ve seen companies do this in many different ways, so you’ll have to consider the best option for you. One option is to allow employees to accrue PTO after a short passage of time. You could create a system where once a week or once a month, every employee accrues a designated amount of PTO hours. Another option when considering accrual frequency is to allow employees to accrue time based on the number of hours they work. The final accrual frequency you might consider is one where employees earn micro-amounts of PTO every day based on hours worked. While many employees favor this kind of policy, it can be a headache for the HR team to handle. Accrual Amount. Accrual amount is simply the number of hours you grant to employees at each accrual. When considering how many hours to allow your employees to accrue each year, we recommend thinking about the following things. First, ask yourself how important it is to recruit and hire truly great people to come and work for your company. If you need elite talent or highly skilled workers, you’ll be competing with many other businesses for those employees. Offering generous amounts of PTO is one way to attract great talent. Second, you’ll want to determine how PTO fits into your company’s business structure. If your business literally cannot afford to have certain people miss extended periods of work, then you might offer less paid hours away from work. Finally, you may decide to create different accrual schedules (as well as determine different accrual amounts) for part-time and full-time employees.Milestones. The next aspect of your accrual-based PTO policy to consider is tenure milestones. In many companies, employees who have worked at the company longer are either granted more frequent accruals or accrue more hours than the average employee. Milestones are incredibly easy to integrate into a policy. They’re also a fantastic way to reward long-tenured employees. Max balance. The max balance is simply the maximum number of hours an employee can accrue. Some employers choose to cap accruals for various reasons. One common reason is to encourage employees to use the PTO they’re accruing. If an employee never takes a vacation, it’s actually detrimental to their health, and it negatively impacts the company. With a max balance, an employee cannot accrue more time off until they’ve used some of the time they have stored. Another common reason is to cap an employers’ liability. In some states, employers are liable for the number of PTO hours accrued by their employees. If the employer were to terminate an employee who had 50 hours of PTO accrued, they’d have to pay out the equivalent of 50 hours worth of wages when the employee leaves the company.Carry-over limits. One final decision you’ll make when creating your accrual-based PTO policy is in regards to carry-over limits. A carry-over limit dictates how many hours of unused PTO an employee can carry over from year to year. Carry-over limits are common but are not universal. Many employers do not place a carry-over limit on PTO and allow employees to maintain their balance regardless of when the time was accrued. Companies who use carry-over limits may do so in different ways. Some companies designate a “max carry-over” that outlines the maximum number of hours an employee can carry from one year to the next. Other companies simply do not permit any carry-over and force employees to use the time accrued in the year it was allotted. The reasons for a carry-over limit are similar to the reasons for a max balance. If an employee knows that they’ll potentially lose the PTO they’ve accrued, they’re more likely to use it. Additionally, carry-over limits can reduce employer liability for unused time off.

Step 4: Determine the Logistics

Identify the system you would like to use to track earned, saved and spent PTO. This may be on spreadsheets that you create yourself or by using a PTO management software like Eddy to automate things for you.

Step 5: Write Your Policy, Revise and Communicate It to Your Company

Once you have determined the details and logistics of your accrual PTO plan, all you need to do is write out your policy, revise it and communicate it to your team. We recommend that you have a mentor, colleague or attorney review your policy and make suggestions before making it official at your company. When communicating your new PTO policy to your company, you’ll want to make sure that it is accessible to all your employees. This can be done by sending out an email, adding the policy to the employee handbook and even providing a physical copy to your employees.

How to Calculate How Much PTO an Employees Has Accrued

While many HR applications may calculate PTO accruals for you, here are some guidelines for calculating accrued PTO for your employees should you need to pay out unused PTO or simply help an employee understand their balance. For purposes of this article, an employee earns $20 per hour and accrues one hour of PTO for every 40 hours that they work. The employee has worked 2,000 hours.

Step 1: Divide

Divide the number of hours that the employee has worked (2,000) by the number of hours it takes to earn an hour of PTO (40): 2,000 hours worked / 40 hours = 50 total hours of accrued PTO

Step 2: Subtract

If you want to know the employee’s current PTO balance, you can do so by subtracting the amount of used PTO (20 hours) from the total amount of accrued PTO (50 hours), which was calculated in Step 1: 50 total hours of PTO - 20 used hours = 30 hours PTO balance

Step 3: Multiply

Now, since we have the amount of unused PTO hours (30), we can calculate how much money needs to be paid out for the employee’s PTO if they are leaving the company. We will need the employee’s hourly wage ($20/hr) to do this. We will multiply the number of unused hours by the hourly wage to get the total amount that is to be remitted to the employee: 30 hours of unused PTO * $20/hour = $600 to be paid out

Tips for Creating a Successful PTO Accrual Policy

Here are some additional tips for creating a successful PTO accrual policy.

Tip 1: Cater Your Policy to Their Needs

Make sure that you cater your policy to the culture and needs of your employees, specifically as it relates to the frequency at which they accrue PTO. Employees at some companies may prefer receiving all of their PTO up front each year and then accruing their PTO from year to year, while some might prefer earning PTO on a monthly basis. It really depends on various factors, including turnover frequency and average employee tenure at the company.

Tip 2: Ensure Your Budget is Prepared

Make sure that your budget is prepared for payouts if that is required in your state or if you have employees in a state where a PTO payout is required upon leaving the company. These payouts can get really expensive, especially if you don’t establish an accrual limit or that limit is very high.

Tip 3: Connect With HR Mentors

Consider connecting with HR mentors in similar industries to learn how they do PTO and how they think your employees would respond to a specific plan. While every company is different, there may be similarities between work cultures in the same industry. This may give you insights into how you can craft an effective accrual-based PTO policy. Wondering where to get started? HR Mavericks is a group of HR pros who share knowledge in many ways, including connecting with fellow members one-on-one and answering their questions in a community Slack channel. Join HR Mavericks for free!

Example Accrual-Based PTO Policy

Here is an example of an accrual-based PTO policy with carryover and accrual guidelines: Purpose [Company] has designed a paid time off (PTO) plan to assist employees with finding a healthy work-life balance. All full-time employees at [Company] will be added to this PTO plan, which combines all vacation, personal and sick leave into one singular program. Accrual Schedule PTO will be earned and accrue according to the following schedule and years worked at the company. PTO is accrued per pay period, which is semi-monthly. 0-1 years: 2.5 hours per pay period or 7.5 days per year 2-3 years: 3.5 hours per pay period or 10.5 days per year 4-5 years: 4.5 hours per pay period or 13.5 days per year For purposes of this policy, there are 24 pay periods in a year, a day is 8 hours and the year begins on the employee’s date of hire. Procedures All PTO usage must be requested and approved by HR and the employee’s supervisor, using [Company’s] HR software. Employees will record PTO usage for vacation, sick, family and extra holiday leave. If needed and with approval of their supervisor, an employee may enter into a negative PTO balance before accruing their hours. Employees must request PTO usage at least 2 weeks in advance of their intended absence. Requests made within 2 weeks of the intended absence date may be denied if there is a job-related scheduling conflict. For sick leave, employees should contact their supervisor the morning of their absence to notify them. Employees may carry over a maximum of 30 hours of unused PTO time from one calendar year to the next and may hold a total maximum balance of 150 hours of unused PTO time at a time. If an employee should leave the company with a balance of unused PTO, they will be paid for all of the said PTO in the form of their final paycheck and according to their hourly wage. Employees will not be able to receive a payout for PTO while they are currently employed by the company.

Create the Right PTO Accrual Plan for Your Company

Accrual-based PTO policies can take many twists and turns. There is no “best” way to create a plan. Each question needs to be answered while considering the other factors of the equation. The right PTO plan for one company will most certainly not be the right one for another. As you build out your plan, be sure to take your time. Think through each question individually and cohesively. As you do so, you’ll create a PTO policy that works best for your business.

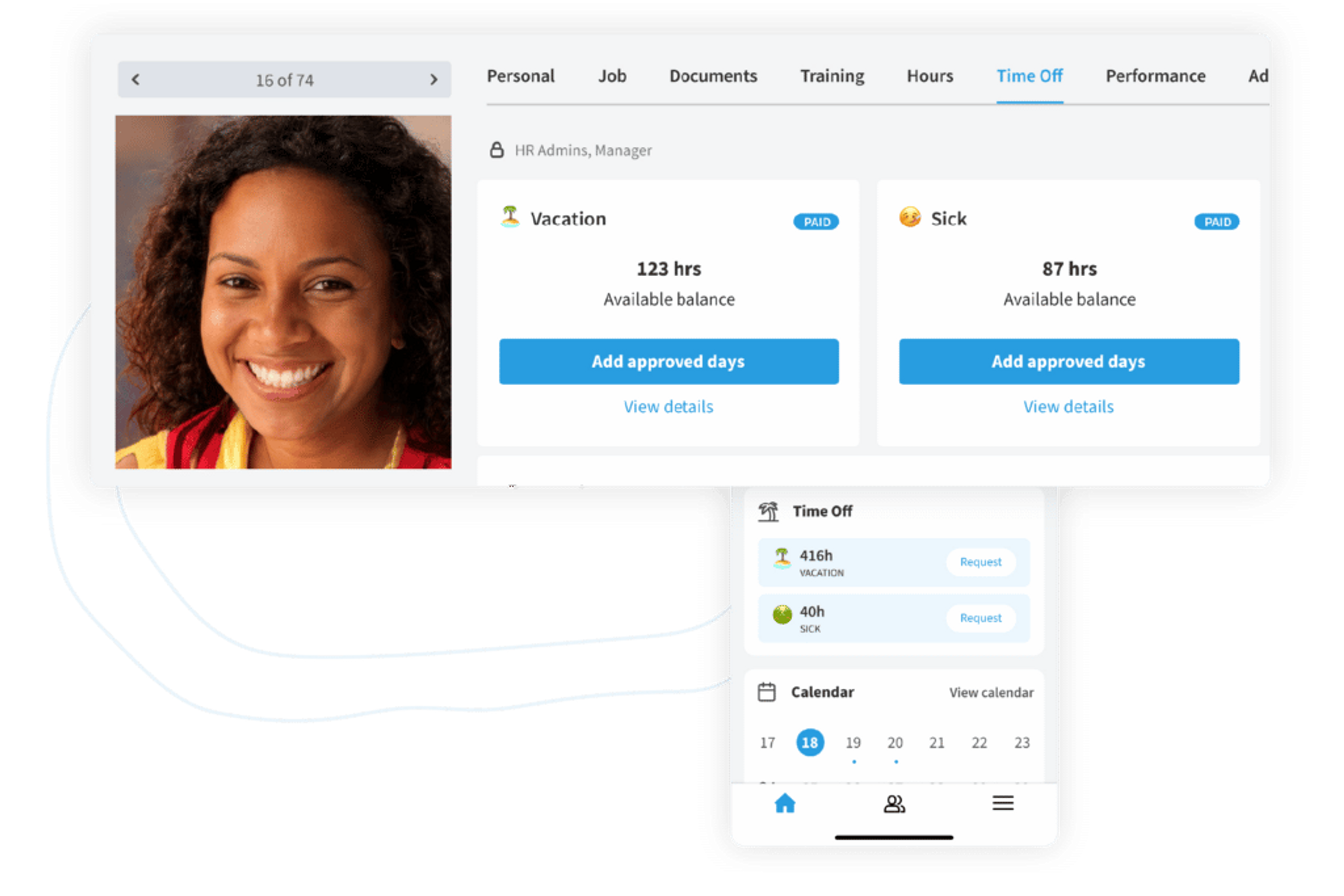

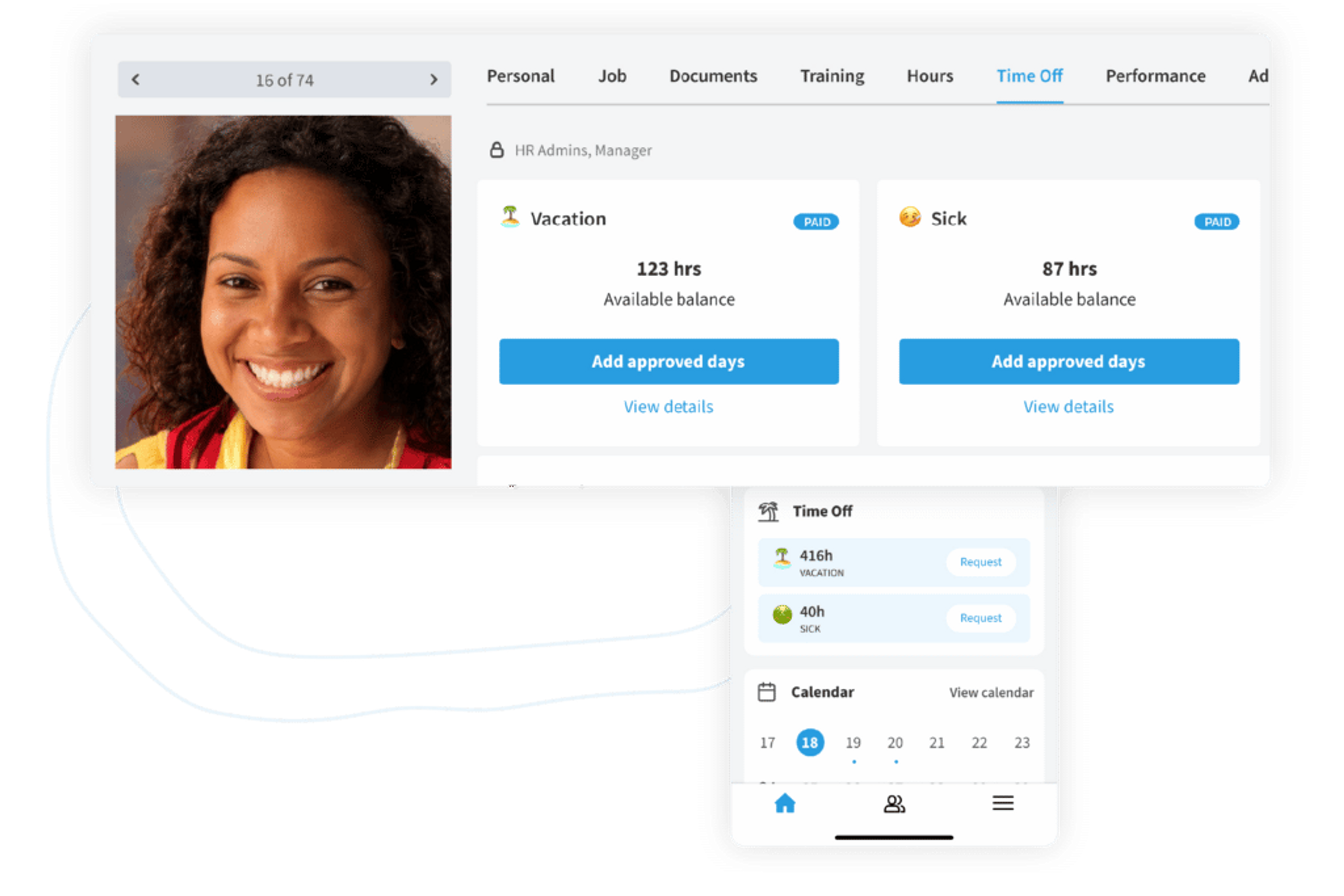

How Eddy People Can Simplify Your PTO Processes

Eddy People is part of an all-in-one HR software solution reducing the administrative load on small business owners and HR leaders. While creating custom PTO plans in spreadsheets can take hours, it only takes a few minutes with Eddy. With easy-to-access PTO balances, one-click time off approval, and a company-wide time off calendar, Eddy People is a powerful time management tool. And that’s just the beginning.

Topics

Chris Ruddy

Chris is an HR entrepreneur. Having worked with small businesses and start-ups throughout his career, Chris is passionate about pioneering HR departments in companies where they don’t currently exist. He currently works at Skill Struck, a local Utah tech company and is striving to be an expert in all things related to small business HR departments.

Frequently asked questions

Other Related Terms

Eddy’s HR Mavericks Encyclopedia

PTO Accrual

Is an accrual PTO plan right for you? In an age of increasing employee benefits driven by a competitive job industry, choosing the right paid time off plan is critical to attracting and retaining top talent. In this article, you’ll learn about accrual PTO plans and how you can implement one in your company!

What Is PTO Accrual?

Paid time off (or PTO) is one of the many benefits employers may offer to employees. Although PTO is not required by federal law, giving employees some time away from work has been proven to be overwhelmingly positive for both the worker and the company. In fact, over 73% of businesses offer PTO to their employees, and the average employee takes around 10 days off work each year. PTO accrual, or accrued PTO, is the type of PTO that employees can earn over time. It is often treated like a vested benefit or “bank account” for time off, where PTO days are earned, saved and spent like money would be with a bank account. In some cases, employees can even cash out their unused PTO days when they leave the company. PTO accrual plans often include maximum balances, where employees cannot accrue over a certain amount each year or during their tenure at the company.

Lump Sum vs Accrued PTO

With accruing PTO, employees will earn PTO per a certain period of time throughout the year (chosen by the employer). Employees will be able to save that PTO for another year, instead of having it expire annually like with use-it-or-lose-it PTO policies. Using the lump sum method, employees are given a set number of PTO days each year. They receive all their days at once, and at the end of the year, the days either roll over to the next year or expire. With lump sums, employees often receive more PTO days when they hit an important milestone; for example, when they reach 5 years at the company, they might receive additional PTO.

Is an Accrual Policy Right for Your Company?

As with every benefit your company implements, it’s important to consider what experience and culture you are trying to foster at your company. Here are some reasons why an accrual PTO policy might be right for your company:

- Your employees don’t currently have PTO. An accrual PTO plan is very standard across most industries and is a great place to start when setting up a PTO plan for your company.

- You don’t want your employees’ PTO to expire. Accrual PTO plans are a great option if you don’t want your employees’ PTO to expire.

- You want employees to own their PTO. Because accrued PTO does not expire like use-it-or-lose-it PTO, employees feel a sense of ownership over their PTO.

- Your company is financially ready. You feel that your company is ready for any financial implications or payouts associated with accrued PTO. Some states require that unused PTO is paid out to the employee when they leave the company.

How to Implement PTO Accrual

While there is no set way to set up a PTO accrual policy for your company, here is a general guide to help you get started:

Step 1: Consider Why and for Whom You Are Adding a PTO Policy

Before writing your policy, consider why you are looking to create a PTO policy in general and why you want it to be an accrual policy instead of a use-it-or-lose-it policy. What work culture are you trying to foster at your company and how does an accrual PTO policy contribute to that? Also consider which employees will be added to the PTO policy (i.e., full-time, part-time, exempt, nonexempt employees).

Step 2: Consider Legal Requirements And Potential Budgetary Costs for Payout

Take a look at the labor and PTO laws of the state(s) where you have employees. When drafting your PTO policy, you’ll need to consider what the requirements are for each state where you have employees. Some states may require a cash payout of PTO when an employee leaves the company. If this is the case in your state, you may want to consider the budgetary implications of such an accrual PTO policy.

Step 3: Decide the Details of Your PTO Policy

When figuring out the details of your company's PTO accrual policy, there are several key factors to take into consideration: Accrual Frequency. When creating your PTO plan, you’ll first want to ask yourself about the accrual frequency. We’ve seen companies do this in many different ways, so you’ll have to consider the best option for you. One option is to allow employees to accrue PTO after a short passage of time. You could create a system where once a week or once a month, every employee accrues a designated amount of PTO hours. Another option when considering accrual frequency is to allow employees to accrue time based on the number of hours they work. The final accrual frequency you might consider is one where employees earn micro-amounts of PTO every day based on hours worked. While many employees favor this kind of policy, it can be a headache for the HR team to handle. Accrual Amount. Accrual amount is simply the number of hours you grant to employees at each accrual. When considering how many hours to allow your employees to accrue each year, we recommend thinking about the following things. First, ask yourself how important it is to recruit and hire truly great people to come and work for your company. If you need elite talent or highly skilled workers, you’ll be competing with many other businesses for those employees. Offering generous amounts of PTO is one way to attract great talent. Second, you’ll want to determine how PTO fits into your company’s business structure. If your business literally cannot afford to have certain people miss extended periods of work, then you might offer less paid hours away from work. Finally, you may decide to create different accrual schedules (as well as determine different accrual amounts) for part-time and full-time employees.Milestones. The next aspect of your accrual-based PTO policy to consider is tenure milestones. In many companies, employees who have worked at the company longer are either granted more frequent accruals or accrue more hours than the average employee. Milestones are incredibly easy to integrate into a policy. They’re also a fantastic way to reward long-tenured employees. Max balance. The max balance is simply the maximum number of hours an employee can accrue. Some employers choose to cap accruals for various reasons. One common reason is to encourage employees to use the PTO they’re accruing. If an employee never takes a vacation, it’s actually detrimental to their health, and it negatively impacts the company. With a max balance, an employee cannot accrue more time off until they’ve used some of the time they have stored. Another common reason is to cap an employers’ liability. In some states, employers are liable for the number of PTO hours accrued by their employees. If the employer were to terminate an employee who had 50 hours of PTO accrued, they’d have to pay out the equivalent of 50 hours worth of wages when the employee leaves the company.Carry-over limits. One final decision you’ll make when creating your accrual-based PTO policy is in regards to carry-over limits. A carry-over limit dictates how many hours of unused PTO an employee can carry over from year to year. Carry-over limits are common but are not universal. Many employers do not place a carry-over limit on PTO and allow employees to maintain their balance regardless of when the time was accrued. Companies who use carry-over limits may do so in different ways. Some companies designate a “max carry-over” that outlines the maximum number of hours an employee can carry from one year to the next. Other companies simply do not permit any carry-over and force employees to use the time accrued in the year it was allotted. The reasons for a carry-over limit are similar to the reasons for a max balance. If an employee knows that they’ll potentially lose the PTO they’ve accrued, they’re more likely to use it. Additionally, carry-over limits can reduce employer liability for unused time off.

Step 4: Determine the Logistics

Identify the system you would like to use to track earned, saved and spent PTO. This may be on spreadsheets that you create yourself or by using a PTO management software like Eddy to automate things for you.

Step 5: Write Your Policy, Revise and Communicate It to Your Company

Once you have determined the details and logistics of your accrual PTO plan, all you need to do is write out your policy, revise it and communicate it to your team. We recommend that you have a mentor, colleague or attorney review your policy and make suggestions before making it official at your company. When communicating your new PTO policy to your company, you’ll want to make sure that it is accessible to all your employees. This can be done by sending out an email, adding the policy to the employee handbook and even providing a physical copy to your employees.

How to Calculate How Much PTO an Employees Has Accrued

While many HR applications may calculate PTO accruals for you, here are some guidelines for calculating accrued PTO for your employees should you need to pay out unused PTO or simply help an employee understand their balance. For purposes of this article, an employee earns $20 per hour and accrues one hour of PTO for every 40 hours that they work. The employee has worked 2,000 hours.

Step 1: Divide

Divide the number of hours that the employee has worked (2,000) by the number of hours it takes to earn an hour of PTO (40): 2,000 hours worked / 40 hours = 50 total hours of accrued PTO

Step 2: Subtract

If you want to know the employee’s current PTO balance, you can do so by subtracting the amount of used PTO (20 hours) from the total amount of accrued PTO (50 hours), which was calculated in Step 1: 50 total hours of PTO - 20 used hours = 30 hours PTO balance

Step 3: Multiply

Now, since we have the amount of unused PTO hours (30), we can calculate how much money needs to be paid out for the employee’s PTO if they are leaving the company. We will need the employee’s hourly wage ($20/hr) to do this. We will multiply the number of unused hours by the hourly wage to get the total amount that is to be remitted to the employee: 30 hours of unused PTO * $20/hour = $600 to be paid out

Tips for Creating a Successful PTO Accrual Policy

Here are some additional tips for creating a successful PTO accrual policy.

Tip 1: Cater Your Policy to Their Needs

Make sure that you cater your policy to the culture and needs of your employees, specifically as it relates to the frequency at which they accrue PTO. Employees at some companies may prefer receiving all of their PTO up front each year and then accruing their PTO from year to year, while some might prefer earning PTO on a monthly basis. It really depends on various factors, including turnover frequency and average employee tenure at the company.

Tip 2: Ensure Your Budget is Prepared

Make sure that your budget is prepared for payouts if that is required in your state or if you have employees in a state where a PTO payout is required upon leaving the company. These payouts can get really expensive, especially if you don’t establish an accrual limit or that limit is very high.

Tip 3: Connect With HR Mentors

Consider connecting with HR mentors in similar industries to learn how they do PTO and how they think your employees would respond to a specific plan. While every company is different, there may be similarities between work cultures in the same industry. This may give you insights into how you can craft an effective accrual-based PTO policy. Wondering where to get started? HR Mavericks is a group of HR pros who share knowledge in many ways, including connecting with fellow members one-on-one and answering their questions in a community Slack channel. Join HR Mavericks for free!

Example Accrual-Based PTO Policy

Here is an example of an accrual-based PTO policy with carryover and accrual guidelines: Purpose [Company] has designed a paid time off (PTO) plan to assist employees with finding a healthy work-life balance. All full-time employees at [Company] will be added to this PTO plan, which combines all vacation, personal and sick leave into one singular program. Accrual Schedule PTO will be earned and accrue according to the following schedule and years worked at the company. PTO is accrued per pay period, which is semi-monthly. 0-1 years: 2.5 hours per pay period or 7.5 days per year 2-3 years: 3.5 hours per pay period or 10.5 days per year 4-5 years: 4.5 hours per pay period or 13.5 days per year For purposes of this policy, there are 24 pay periods in a year, a day is 8 hours and the year begins on the employee’s date of hire. Procedures All PTO usage must be requested and approved by HR and the employee’s supervisor, using [Company’s] HR software. Employees will record PTO usage for vacation, sick, family and extra holiday leave. If needed and with approval of their supervisor, an employee may enter into a negative PTO balance before accruing their hours. Employees must request PTO usage at least 2 weeks in advance of their intended absence. Requests made within 2 weeks of the intended absence date may be denied if there is a job-related scheduling conflict. For sick leave, employees should contact their supervisor the morning of their absence to notify them. Employees may carry over a maximum of 30 hours of unused PTO time from one calendar year to the next and may hold a total maximum balance of 150 hours of unused PTO time at a time. If an employee should leave the company with a balance of unused PTO, they will be paid for all of the said PTO in the form of their final paycheck and according to their hourly wage. Employees will not be able to receive a payout for PTO while they are currently employed by the company.

Create the Right PTO Accrual Plan for Your Company

Accrual-based PTO policies can take many twists and turns. There is no “best” way to create a plan. Each question needs to be answered while considering the other factors of the equation. The right PTO plan for one company will most certainly not be the right one for another. As you build out your plan, be sure to take your time. Think through each question individually and cohesively. As you do so, you’ll create a PTO policy that works best for your business.

How Eddy People Can Simplify Your PTO Processes

Eddy People is part of an all-in-one HR software solution reducing the administrative load on small business owners and HR leaders. While creating custom PTO plans in spreadsheets can take hours, it only takes a few minutes with Eddy. With easy-to-access PTO balances, one-click time off approval, and a company-wide time off calendar, Eddy People is a powerful time management tool. And that’s just the beginning.

Topics

Chris Ruddy

Chris is an HR entrepreneur. Having worked with small businesses and start-ups throughout his career, Chris is passionate about pioneering HR departments in companies where they don’t currently exist. He currently works at Skill Struck, a local Utah tech company and is striving to be an expert in all things related to small business HR departments.

Frequently asked questions

Other Related Terms

Eddy's HR Newsletter

Sign up for our email newsletter for helpful HR advice and ideas.