QuickBooks Online

Popular

Overview

Easily track income, expenses, and more with accounting software designed for all kinds of businesses.

Accounting

Publisher

Quickbooks Online

Pricing

No additional charge

Help Center

Eddy help center

Eddy + QuickBooks Online

Eddy has created an integration with QuickBooks Online.

Integration Overview

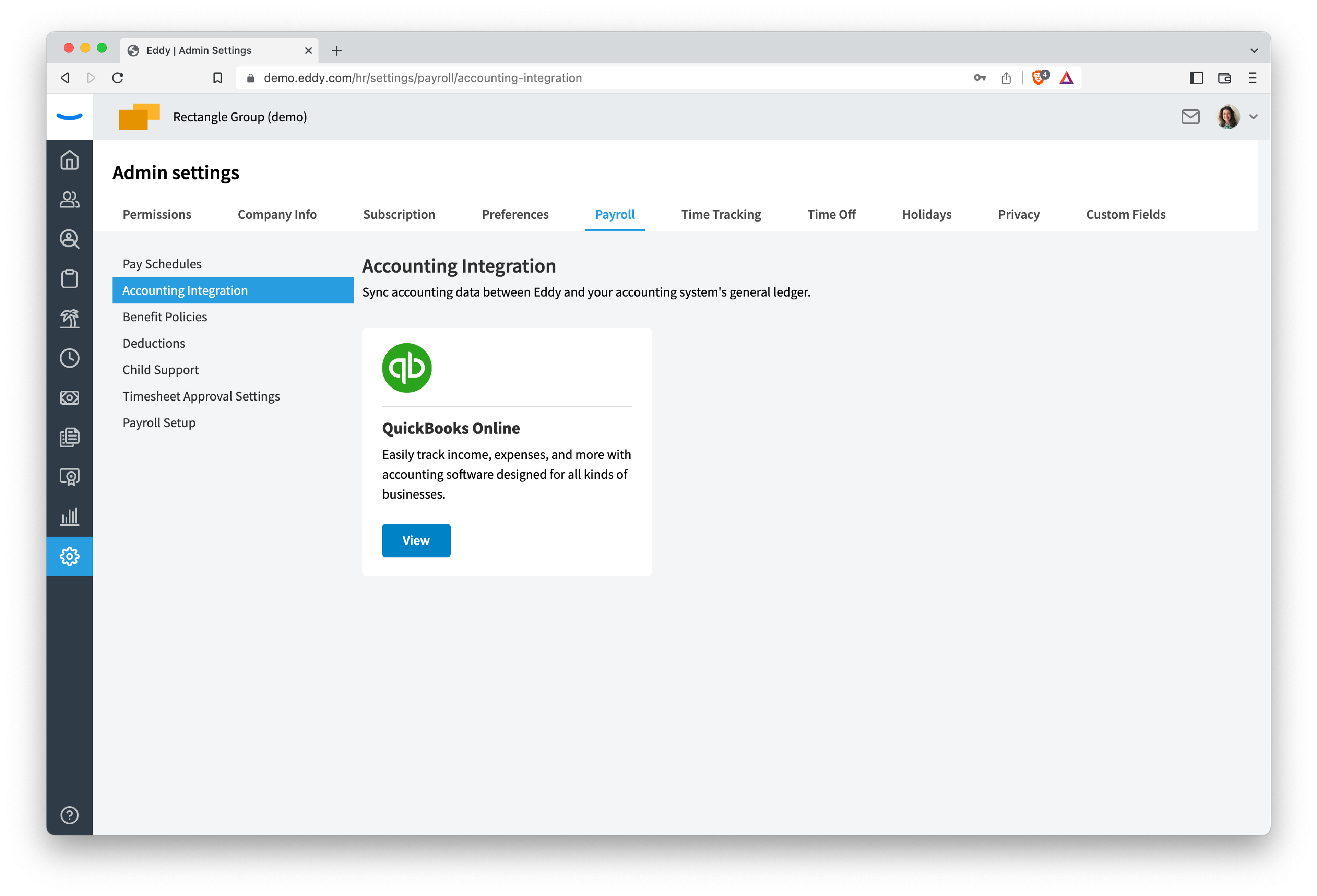

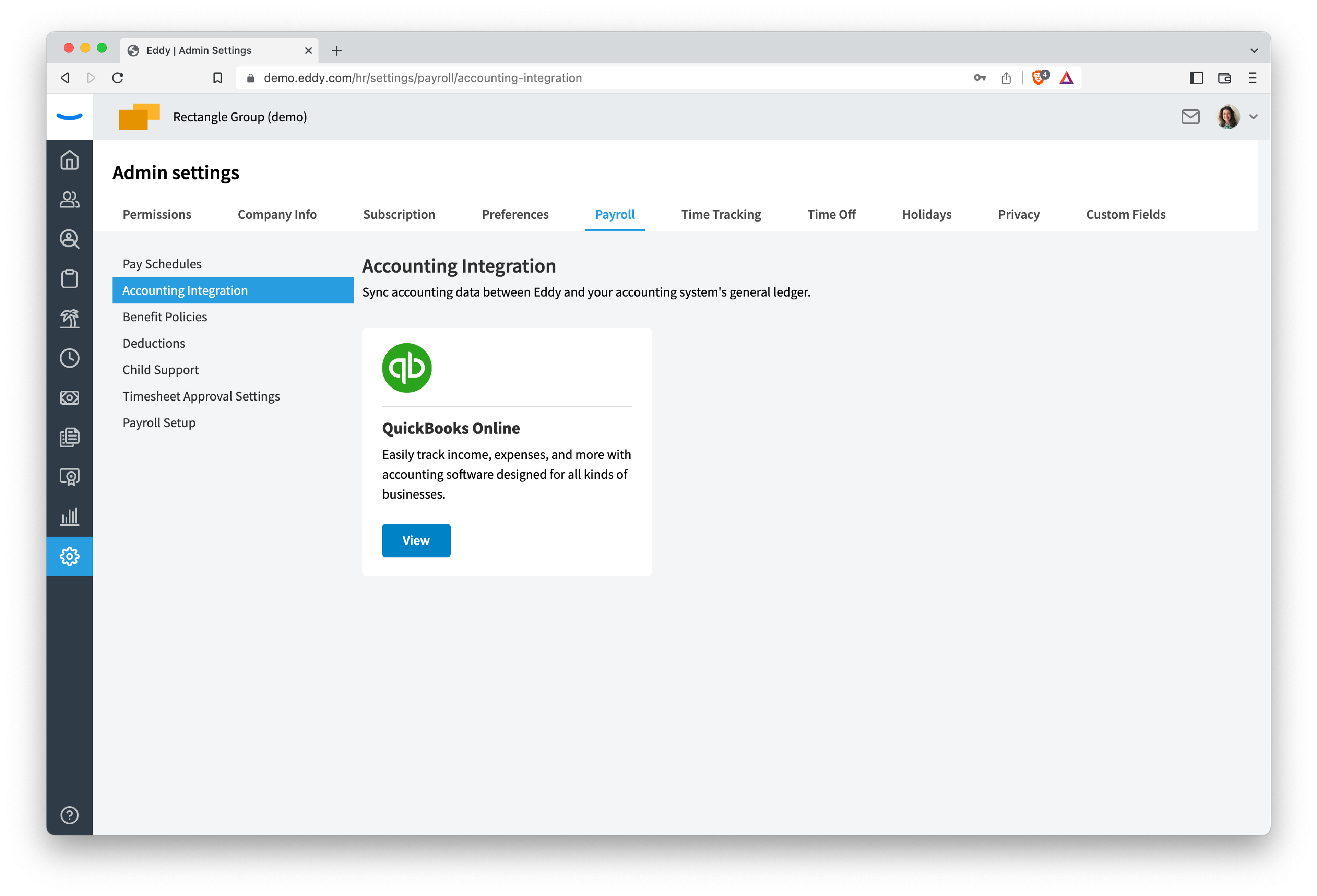

To connect QuickBooks Online, go to Admin settings and select the Payroll tab. On the side menu you'll see a link for Accounting integration. Click this link to view the available integrations (for now QuickBooks Online is the only option). On the QuickBooks Online card click the View button to get started.

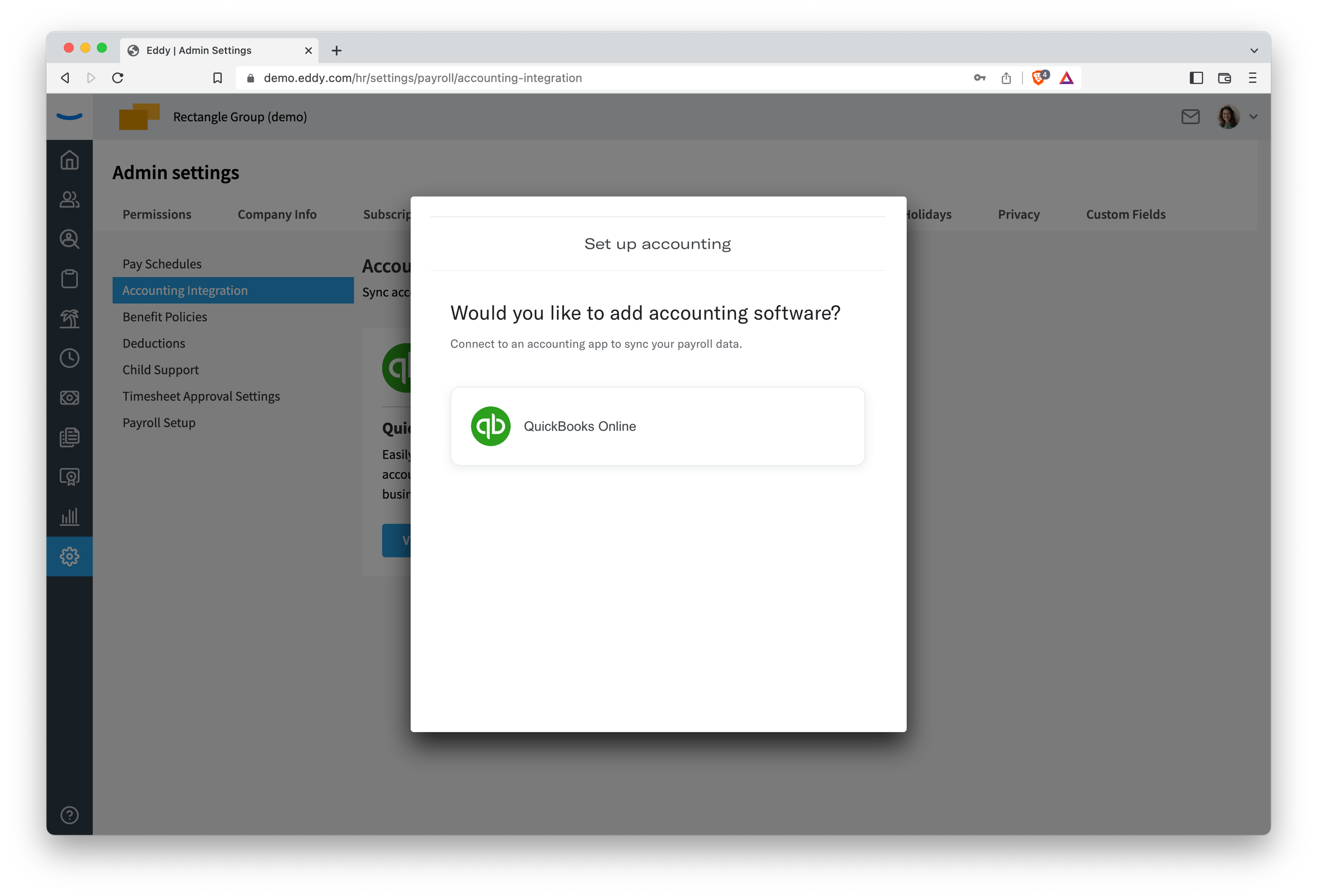

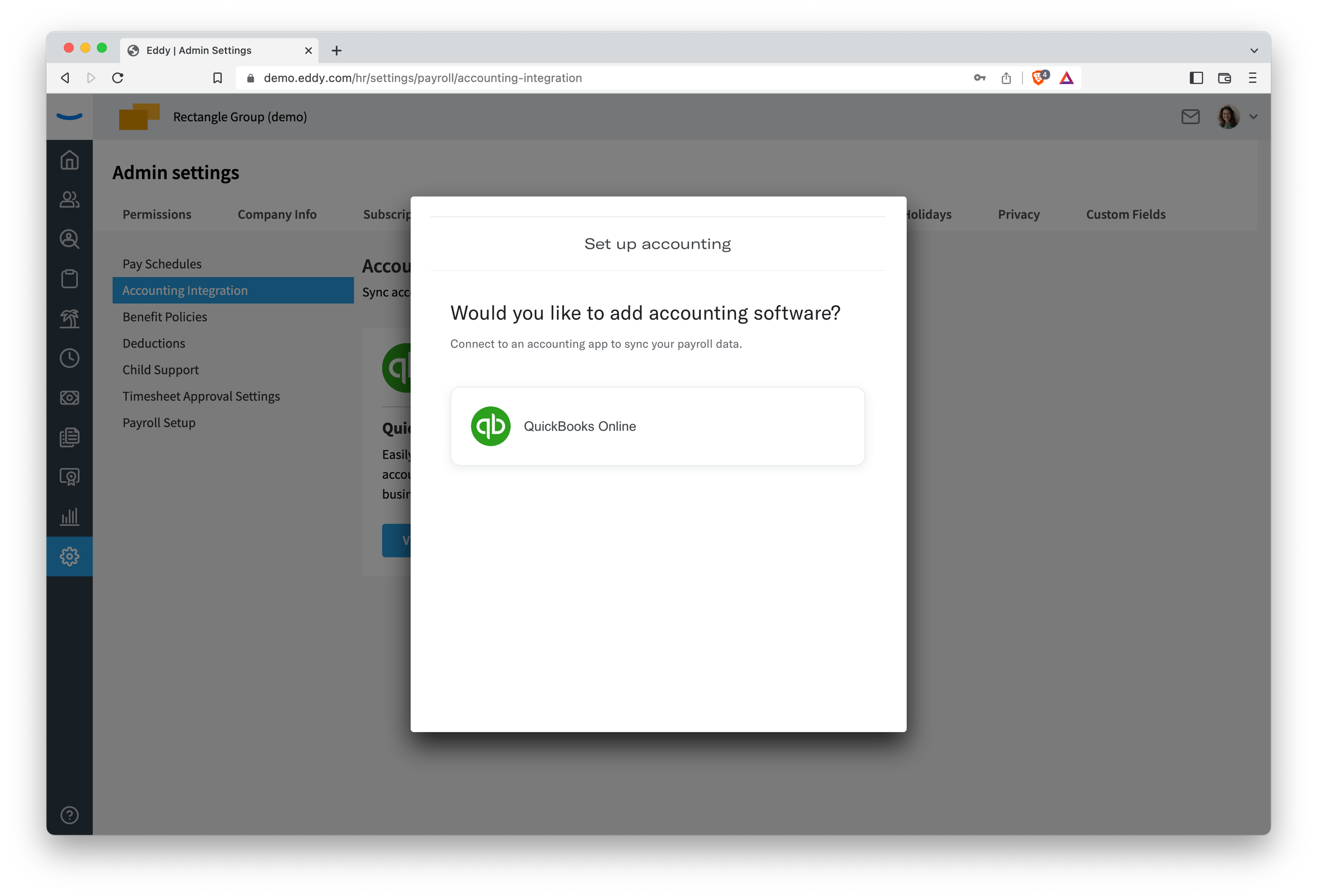

Next you'll click the QuickBooks Online link to open a window that lets you log in and authorize connecting to their Quickbooks Online account.

Integration Type

via API

Direction of Data Flow

one-way

Sync Schedule

As payroll run enters "processing" state

Sync frequency

As payroll run enters "processing" state

How to enable the integration

To connect QuickBooks Online, go to Admin settings and select the Payroll tab. On the side menu you'll see a link for Accounting integration. Click this link to view the available integrations (for now QuickBooks Online is the only option). On the QuickBooks Online card click the View button to get started.

What data syncs?

| Info In Eddy | Sync Direction | Name of Info In QuickBooks Online | Notes |

|---|---|---|---|

| Wages and salaries | Eddy to partner | Wages and salaries | All earnings paid to employees and contractors in the pay period. |

| Contractor Payments | Eddy to partner | Contractor Payments | All earnings paid to contractors in the pay period. (Also known as “Compensation”. ) |

| Expense Reimbursements | Eddy to partner | Expense Reimbursements | All reimbursements paid to employees and contractors in the pay period. |

| Employer Taxes | Eddy to partner | Employer Taxes | All employer taxes for the pay period. |

| Employee Benefits | Eddy to partner | Employee Benefits | All benefits paid by the employer and remitted by the employer for the pay period. |

| Bank Account | Eddy to partner | Bank Account | The account that funds the amount that the employer is liable for over a given pay period. |

| Payroll Taxes Payable | Eddy to partner | Payroll Taxes Payable | All employer taxes to be paid -- i.e. not remitted by Eddy. |

| Cash Tips | Eddy to partner | Cash Tips | All cash tips paid to employees directly |

| Imputed Income | Eddy to partner | Imputed Income | Other imputed income such as use of a company car or gym membership |

| Other Payroll Liabilities | Eddy to partner | Other Payroll Liabilities | All employer benefits and PTDs to be paid out by the employer -- i.e. not managed by Eddy. |

About QuickBooks Online

QuickBooks is one of the most popular accounting software for small businesses

QuickBooks Online

Popular

Overview

Easily track income, expenses, and more with accounting software designed for all kinds of businesses.

Accounting

Publisher

Quickbooks Online

Pricing

No additional charge

Help Center

Eddy help center

Eddy + QuickBooks Online

Eddy has created an integration with QuickBooks Online.

Integration Overview

To connect QuickBooks Online, go to Admin settings and select the Payroll tab. On the side menu you'll see a link for Accounting integration. Click this link to view the available integrations (for now QuickBooks Online is the only option). On the QuickBooks Online card click the View button to get started.

Next you'll click the QuickBooks Online link to open a window that lets you log in and authorize connecting to their Quickbooks Online account.

Integration Type

via API

Direction of Data Flow

one-way

Sync Schedule

As payroll run enters "processing" state

Sync frequency

As payroll run enters "processing" state

How to enable the integration

To connect QuickBooks Online, go to Admin settings and select the Payroll tab. On the side menu you'll see a link for Accounting integration. Click this link to view the available integrations (for now QuickBooks Online is the only option). On the QuickBooks Online card click the View button to get started.

What data syncs?

| Info In Eddy | Sync Direction | Name of Info In QuickBooks Online | Notes |

|---|---|---|---|

| Wages and salaries | Eddy to partner | Wages and salaries | All earnings paid to employees and contractors in the pay period. |

| Contractor Payments | Eddy to partner | Contractor Payments | All earnings paid to contractors in the pay period. (Also known as “Compensation”. ) |

| Expense Reimbursements | Eddy to partner | Expense Reimbursements | All reimbursements paid to employees and contractors in the pay period. |

| Employer Taxes | Eddy to partner | Employer Taxes | All employer taxes for the pay period. |

| Employee Benefits | Eddy to partner | Employee Benefits | All benefits paid by the employer and remitted by the employer for the pay period. |

| Bank Account | Eddy to partner | Bank Account | The account that funds the amount that the employer is liable for over a given pay period. |

| Payroll Taxes Payable | Eddy to partner | Payroll Taxes Payable | All employer taxes to be paid -- i.e. not remitted by Eddy. |

| Cash Tips | Eddy to partner | Cash Tips | All cash tips paid to employees directly |

| Imputed Income | Eddy to partner | Imputed Income | Other imputed income such as use of a company car or gym membership |

| Other Payroll Liabilities | Eddy to partner | Other Payroll Liabilities | All employer benefits and PTDs to be paid out by the employer -- i.e. not managed by Eddy. |

About QuickBooks Online

QuickBooks is one of the most popular accounting software for small businesses