Eddy’s HR Mavericks Encyclopedia

The world's largest free encyclopedia of HR, with 700+ HR articles and podcasts.

Created by Eddy and our HR Mavericks community.

FICA Tax

FICA. Do you flinch with uncertainty when you hear the term? Let us help you get comfortable with what this tax is all about and how to calculate, report, and pay it.

What Is FICA?

The Federal Insurance Contributions Act, commonly known as FICA, is a combination of Social Security and Medicare taxes.

History of FICA

In 1934, as the United States was at the tail end of the Great Depression, the confidence of the country was at an all-time low. President Franklin D. Roosevelt chose a social insurance approach as a way to combat the problem of economic security. The Social Security Act was signed into law on August 14, 1935. Social Security provides income during retirement income, disability benefits, and benefits to children whose parents have passed. In 1962, President John F. Kennedy introduced his plan to create a health care program for older Americans using their Social Security contributions. Congress did not approve it, but in 1964, President Lyndon B. Johnson called on Congress to create a health care program for those 65 and older. It passed on July 30, 1965, creating a two-part Medicare program (Part A covering hospitalization and Part B, medical care). Medicare has since expanded to include other individuals to enroll, such as those with disabilities. Both of these programs are funded by taxes deducted directly from paychecks. This process is regulated and administered by the US Social Security Administration, or SSA.

Current Rates

As of 2023, the current FICA rate is 15.3%: 6.2% for the employer's portion of Social Security and 6.2% for the employee; and 1.45% for the employer's portion of Medicare and 1.45% for the employee's portion. To check on the most current rate, click here.

How to Calculate FICA Tax

Reporting FICA is required and applies to most employers. You either file your reports quarterly using Form 941 or annually using Form 944. Form 944 is generally used for small employers whose annual liability is less than $1,000. Click here if you're not sure which form you should use. For our example report, we'll use Form 941. Form 941 reports the total taxes withheld during a quarter of the year; we'll say Q3. To complete Form 941, you need to total the following for each employee: wages paid, tips received, federal and Medicare taxes paid, and any compensation paid.

Step 1: Gather Employee Forms

In order to report FICA, your employees must complete federal and, if applicable, state W-4 forms. The W-4 forms detail how much federal and/or state income tax will be withheld from each paycheck.

Step 2: Conduct Employee Census

To begin, make a list of all employees who worked during Q3. You do not need to include those employees who are in a non-pay status (leave of absence), farm employees, employees who are designated as household employees (those who are housekeepers, gardeners, or perform work in a private residence as your employee) or active members of the U.S. Armed Forces. For each employee on the census, perform the following calculations.

- Compensation. Calculate the total wages your organization paid each employee during Q3. This includes tips and any other type of compensation paid to your employees, such as sick pay paid by your organization or a third-party administrator. If there are wages that are not subject to FICA (such as payment paid after an employee’s death), you do not need to report those wages; however, you must indicate it on Form 941.

- Federal Income Tax. Calculate the amount of Federal Income Tax withheld during Q3 for each employee. Be sure to include tips, fringe benefits that are taxable, and supplemental unemployment compensation benefits.

Step 3: Do the Math

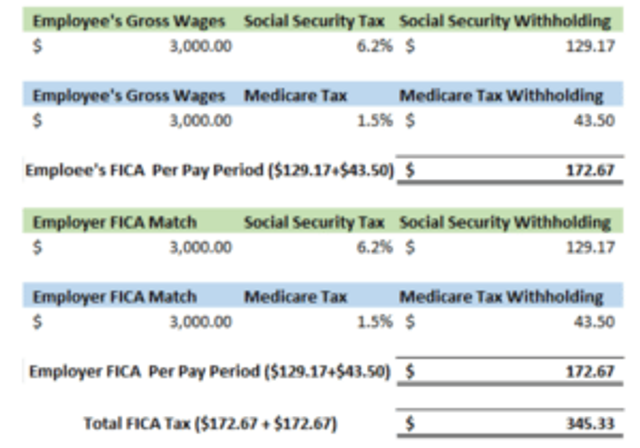

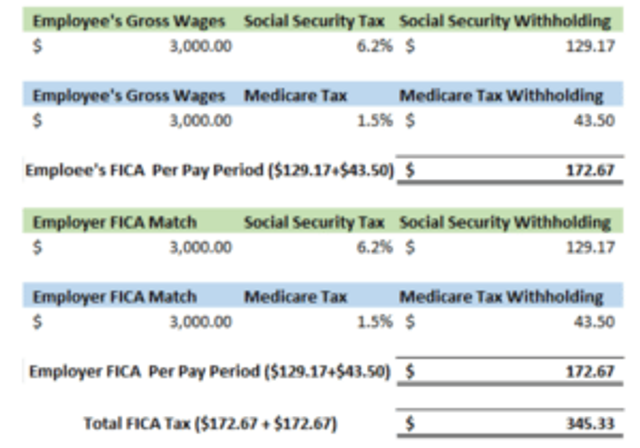

To calculate your employees’ FICA tax, multiply the employees’ gross pay by the Social Security tax rate (6.2 %) and the Medicare rate (1.45%). Since the rates are the same for employers and employees, once you've calculated the employee's contribution, you know the employer portion as well. Sample Calculation In the example below, we calculate FICA for an employee whose gross wages for Q3 were $3000.00.

Step 4: Find Totals

Now that you've calculated the FICA contributions for each employee, add them to sum all employee and employer taxes paid for Q3. Now you are ready to pay your taxes—or deposit them, as the IRS refers to it, because you are making a deposit that will be repaid in the future in the form of benefits.

How to Pay FICA Taxes

How you pay Social Security, Medicare and other federal income taxes depends on whether you file quarterly or annually. For those who file quarterly, due dates are April 30, July 31st, October 31st, and January 31st (for the fourth quarter of the previous year). For those who file annually, the due date is January 31st. The IRS provides two deposit schedules: monthly and sem-weekly. You must determine which of the two deposit schedules you are required to use. To determine your payment schedule, review Publication 15 for forms 941, 944, and 945. For form 943, review Publication 51. All federal tax deposits are required to be made via electronic fund transfer (EFT). Organizations are required to use a federal tax account, also known as the Electronic Federal Tax Payment System (EFTPS) when making FICA payments. The IRS provides a pin number after setup has been completed. Third-party payroll companies such as Eddy also process payments on your behalf using EFTPS.

Making It Easier: Software

Payroll can be complex. There are tons of forms; federal and local tax rates often change; deadlines to track; and questions from employees, all of which require time and attention. There is a software you can use to streamline your process, and there are services that do it for you. Payroll software (and services from companies such as Eddy) help automate your organization’s payroll processing, including but not limited to keeping up with current federal, state, and local payroll tax rates, ensuring that your payroll forms are completed correctly, and reporting and paying your FICA taxes on time.

Topics

Wendy N. Kelly, MSHRM, PHR, SHRM-CP

Wendy is an HR professional with over 10 years of HR experience in education and health care, both in the private and non-profit sector. She is the owner of KHRServices, a full service HR management agency. She is also SHRM and HRCI certified, serves as a HRCI Ambassador, and voted 2021 Most Inclusive HR Influencer.

Frequently asked questions

Other Related Terms

Eddy’s HR Mavericks Encyclopedia

FICA Tax

FICA. Do you flinch with uncertainty when you hear the term? Let us help you get comfortable with what this tax is all about and how to calculate, report, and pay it.

What Is FICA?

The Federal Insurance Contributions Act, commonly known as FICA, is a combination of Social Security and Medicare taxes.

History of FICA

In 1934, as the United States was at the tail end of the Great Depression, the confidence of the country was at an all-time low. President Franklin D. Roosevelt chose a social insurance approach as a way to combat the problem of economic security. The Social Security Act was signed into law on August 14, 1935. Social Security provides income during retirement income, disability benefits, and benefits to children whose parents have passed. In 1962, President John F. Kennedy introduced his plan to create a health care program for older Americans using their Social Security contributions. Congress did not approve it, but in 1964, President Lyndon B. Johnson called on Congress to create a health care program for those 65 and older. It passed on July 30, 1965, creating a two-part Medicare program (Part A covering hospitalization and Part B, medical care). Medicare has since expanded to include other individuals to enroll, such as those with disabilities. Both of these programs are funded by taxes deducted directly from paychecks. This process is regulated and administered by the US Social Security Administration, or SSA.

Current Rates

As of 2023, the current FICA rate is 15.3%: 6.2% for the employer's portion of Social Security and 6.2% for the employee; and 1.45% for the employer's portion of Medicare and 1.45% for the employee's portion. To check on the most current rate, click here.

How to Calculate FICA Tax

Reporting FICA is required and applies to most employers. You either file your reports quarterly using Form 941 or annually using Form 944. Form 944 is generally used for small employers whose annual liability is less than $1,000. Click here if you're not sure which form you should use. For our example report, we'll use Form 941. Form 941 reports the total taxes withheld during a quarter of the year; we'll say Q3. To complete Form 941, you need to total the following for each employee: wages paid, tips received, federal and Medicare taxes paid, and any compensation paid.

Step 1: Gather Employee Forms

In order to report FICA, your employees must complete federal and, if applicable, state W-4 forms. The W-4 forms detail how much federal and/or state income tax will be withheld from each paycheck.

Step 2: Conduct Employee Census

To begin, make a list of all employees who worked during Q3. You do not need to include those employees who are in a non-pay status (leave of absence), farm employees, employees who are designated as household employees (those who are housekeepers, gardeners, or perform work in a private residence as your employee) or active members of the U.S. Armed Forces. For each employee on the census, perform the following calculations.

- Compensation. Calculate the total wages your organization paid each employee during Q3. This includes tips and any other type of compensation paid to your employees, such as sick pay paid by your organization or a third-party administrator. If there are wages that are not subject to FICA (such as payment paid after an employee’s death), you do not need to report those wages; however, you must indicate it on Form 941.

- Federal Income Tax. Calculate the amount of Federal Income Tax withheld during Q3 for each employee. Be sure to include tips, fringe benefits that are taxable, and supplemental unemployment compensation benefits.

Step 3: Do the Math

To calculate your employees’ FICA tax, multiply the employees’ gross pay by the Social Security tax rate (6.2 %) and the Medicare rate (1.45%). Since the rates are the same for employers and employees, once you've calculated the employee's contribution, you know the employer portion as well. Sample Calculation In the example below, we calculate FICA for an employee whose gross wages for Q3 were $3000.00.

Step 4: Find Totals

Now that you've calculated the FICA contributions for each employee, add them to sum all employee and employer taxes paid for Q3. Now you are ready to pay your taxes—or deposit them, as the IRS refers to it, because you are making a deposit that will be repaid in the future in the form of benefits.

How to Pay FICA Taxes

How you pay Social Security, Medicare and other federal income taxes depends on whether you file quarterly or annually. For those who file quarterly, due dates are April 30, July 31st, October 31st, and January 31st (for the fourth quarter of the previous year). For those who file annually, the due date is January 31st. The IRS provides two deposit schedules: monthly and sem-weekly. You must determine which of the two deposit schedules you are required to use. To determine your payment schedule, review Publication 15 for forms 941, 944, and 945. For form 943, review Publication 51. All federal tax deposits are required to be made via electronic fund transfer (EFT). Organizations are required to use a federal tax account, also known as the Electronic Federal Tax Payment System (EFTPS) when making FICA payments. The IRS provides a pin number after setup has been completed. Third-party payroll companies such as Eddy also process payments on your behalf using EFTPS.

Making It Easier: Software

Payroll can be complex. There are tons of forms; federal and local tax rates often change; deadlines to track; and questions from employees, all of which require time and attention. There is a software you can use to streamline your process, and there are services that do it for you. Payroll software (and services from companies such as Eddy) help automate your organization’s payroll processing, including but not limited to keeping up with current federal, state, and local payroll tax rates, ensuring that your payroll forms are completed correctly, and reporting and paying your FICA taxes on time.

Topics

Wendy N. Kelly, MSHRM, PHR, SHRM-CP

Wendy is an HR professional with over 10 years of HR experience in education and health care, both in the private and non-profit sector. She is the owner of KHRServices, a full service HR management agency. She is also SHRM and HRCI certified, serves as a HRCI Ambassador, and voted 2021 Most Inclusive HR Influencer.

Frequently asked questions

Other Related Terms

Eddy's HR Newsletter

Sign up for our email newsletter for helpful HR advice and ideas.