Eddy’s HR Mavericks Encyclopedia

The world's largest free encyclopedia of HR, with 700+ HR articles and podcasts.

Created by Eddy and our HR Mavericks community.

Pay Period

Do you know that there are different types of pay periods? Understanding what a pay period is, what impacts it has, and how to go about selecting the best pay period for your business is important. Keep reading to get the low down on everything pay-period related.

What Is a Pay Period?

A pay period is a defined period of time used to calculate wages for payroll. The wages are calculated based on time worked during the defined period of time.

Pay Period vs Pay Date

While a pay period and a pay date (or pay day) go together, they are different. A pay date is the day on which funds are issued to the employee, paying them for their work during the associated pay period. There is usually a gap between a pay period and the pay date. Once a pay period has closed, the administrative process begins, reconciling the wages due from the pay period and calculating gross wages the employee earned. After the administration process has completed and the net payment is ready to be issued, the day it is paid out is the pay date.

Types of Pay Periods

There are several types of pay periods. Which you choose impacts how often the pay date occurs as well. Let’s start with the most common types of pay periods you will come across.

Weekly

This pay period captures time work during seven consecutive days. While it is common for businesses to choose the calendar week (Sunday through Saturday), pay periods can start and stop at any day or time of day as long as it is seven consecutive 24-hour periods. This type of pay period is common for labor industries with high turnover, like manufacturing and construction.

Bi-Weekly

It is also common for businesses to choose two consecutive calendar weeks (Sunday thru the second Saturday following) as a pay period. This can also start and stop at any time of day as long as it is 14 consecutive 24-hour periods. This type of pay period is common for general administrative staff and customer services.

Semi-Monthly

This pay period divides the month in half to have two pay periods a month. The first pay period is the 1st – 15th, and the second is the 16th - last day of the month. Because we’re focusing at a higher level on the month as a whole, semi-monthly pay periods run concurrently with calendar days. This type of pay period is common for exempt employees.

Monthly

A pay period may encompass a calendar month. The pay period starts on the first day of the month and ends on the last day of the month. Just like the semi-monthly pay period, it typically runs concurrently with the calendar month. This type of pay period is common for exempt employees and company executives.

Uncommon Pay Periods

There are a few other types of pay periods but they are not as common and typically are only used in certain industries. Daily. When employees are paid the same day they work, they are operating under a daily pay period. The pay date is usually the same day as the pay period. This can be common in gig type roles: musicians, bartenders, etc. Fixed Length/contract. This is common in school districts, where teachers sign a contract for one school year (typically 10 months) but are paid in increments as it is earned. They can choose to take their 10 months' earnings and be paid monthly for 10 months, or to divide their 10 months' earnings over 12 months to have pay dates over the summer break when they are not teaching.

Choosing the Right Pay Period for Your Business

Picking a pay period for your business isn’t hard, but it also shouldn’t be done without intention. Here are a few things to take into consideration when choosing a pay period.

Know the Law

Various laws impact payroll and wage calculation. The Department of Labor’s Wage & Hour Division established the Fair Labor Standards Act (FLSA). When most people think of FLSA, they think of minimum wage, but the FLSA covers way more than that. It establishes when to pay overtime and what is considered a work week, among other things. These things don’t necessarily dictate your pay period, but go hand-in-hand with the processing of it. FLSA is something you need to keep in mind. There are also state-level wage and hour laws. States have their own laws on how long the pay date can be from the pay period. There are also specific final pay laws that can fall outside of your standard pay period/pay date pattern. For example, in the state of Texas, if an employee is terminated involuntarily, the company only has six days to issue their last check. Depending on when the employee terminates, you could still be in a pay period where you are needing to close and process the terminated employee’s pay period while everyone else continues as normal.

Know Your Business/Accounting Needs

Have a discussion internally with your leadership and accounting teams to determine if there is anything on their end that needs to be taken into consideration. For example, it may be easier for a company to choose semi-monthly or monthly pay periods to go along with their standard month-end process. Bi-weekly and weekly pay periods may have them allocating part of a pay period to one month and the rest to the following month if the pay period straddles two months.

Know Your Demographic

One factor in choosing pay periods is understanding your employees, work schedules, and the industry you work in.

- Workforce.Is your workforce composed of business professionals who are primarily exempt status, or is it primarily laborers who turn over frequently? It makes more sense to have a longer pay period for higher-level positions that typically make higher incomes. If your workforce turns over frequently and you’re in states that have final pay laws, a shorter pay period will help cut down on deviating from your standard payroll processes.

- Operations. Do your staffing demands operate outside of the standard Monday-through-Friday/8–5 work schedule? Many technician-type roles have unique work schedules or shift work. For example, a company that employees work in 12-hour shifts that go from 6:00 am to 6:00 pm, you may consider having your pay period start at 6:00 am so a work shift doesn’t straddle two pay periods. Or maybe it helps decrease labor costs by having a shift straddle a pay period because of when the shifts fall into a work week under FLSA. Know that work shifts can impact how difficult and time-intensive paying your employees is.

- Industry. Does your industry have standards? It can be a big adjustment for someone to go from one type of pay period to a different one, especially if it is longer than what they are used to. If you are in an industry that typically uses a specific type of pay period, it may make sense to keep that industry’s practices. This can help alleviate issues that may arise when recruiting.

Examples of Pay Periods

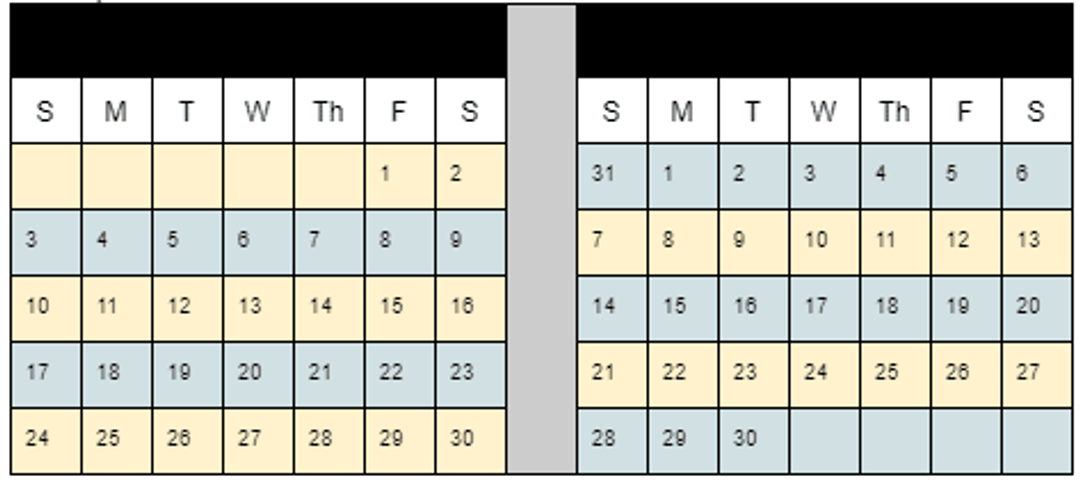

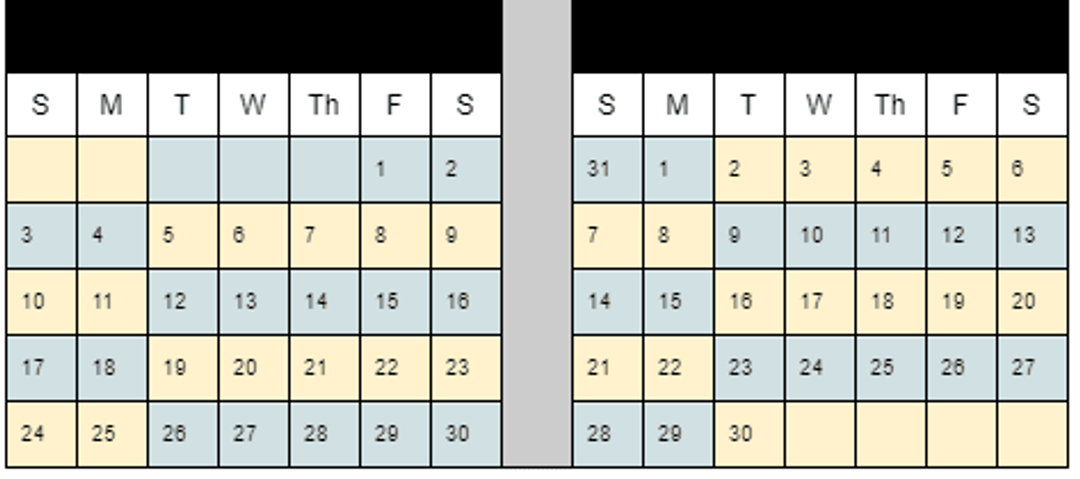

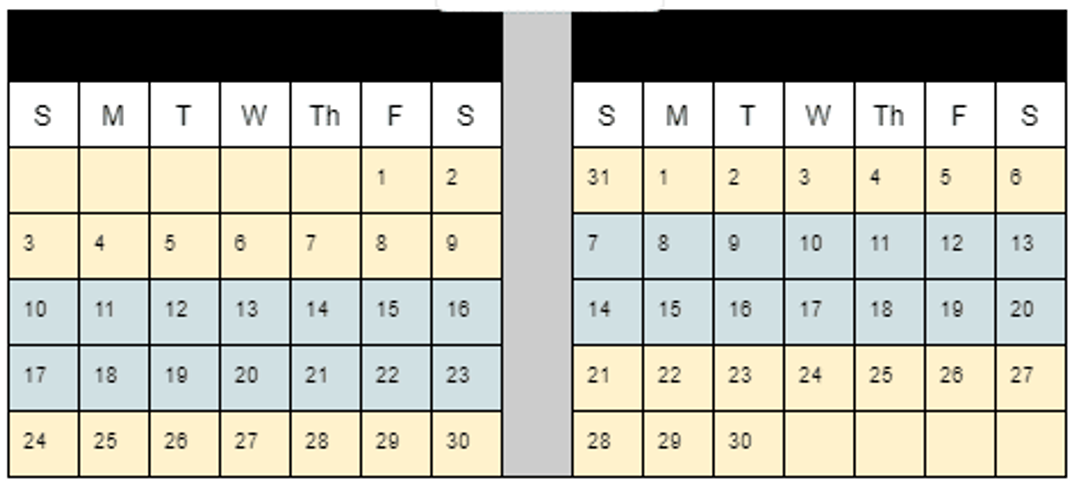

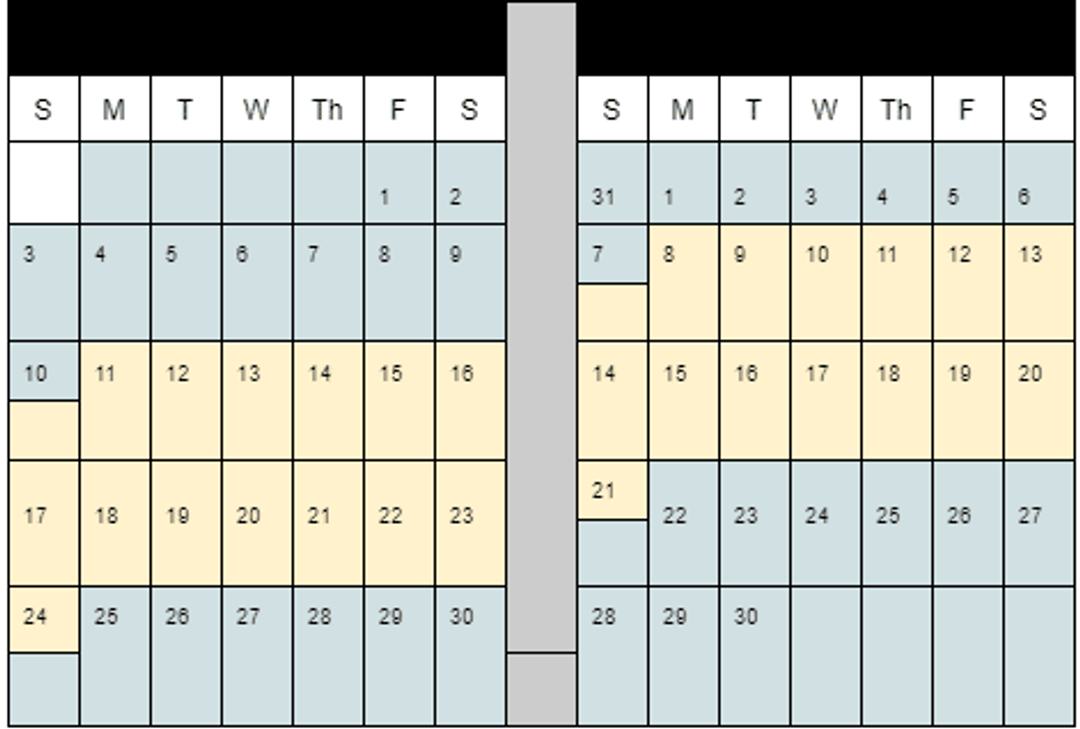

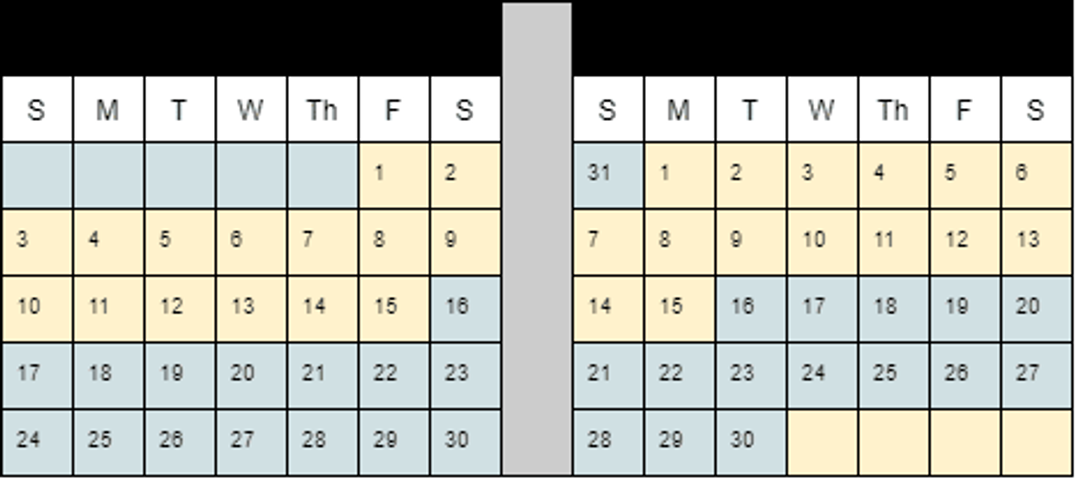

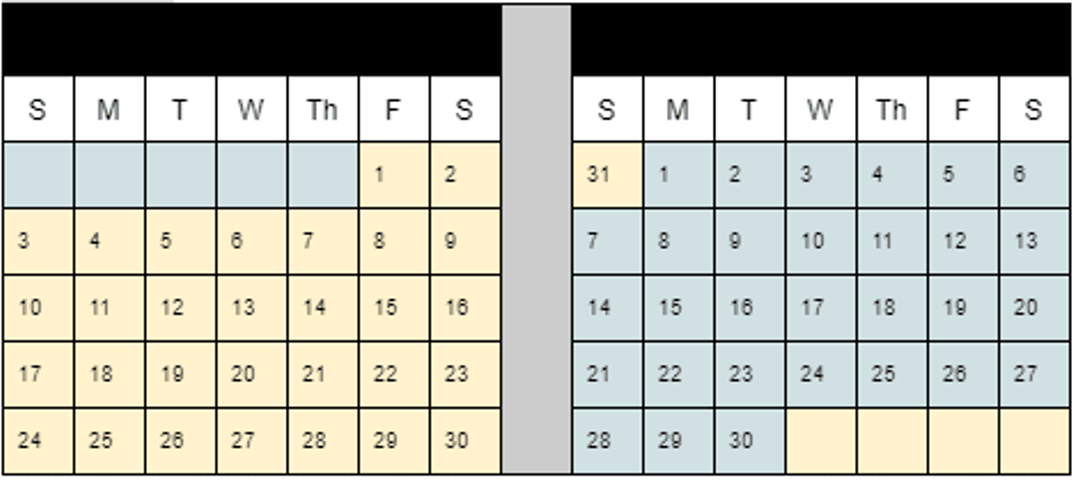

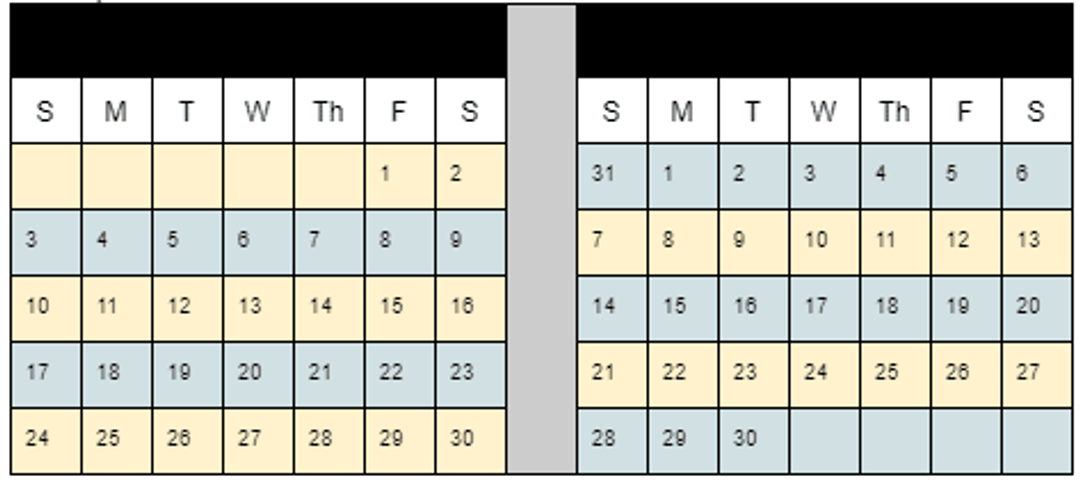

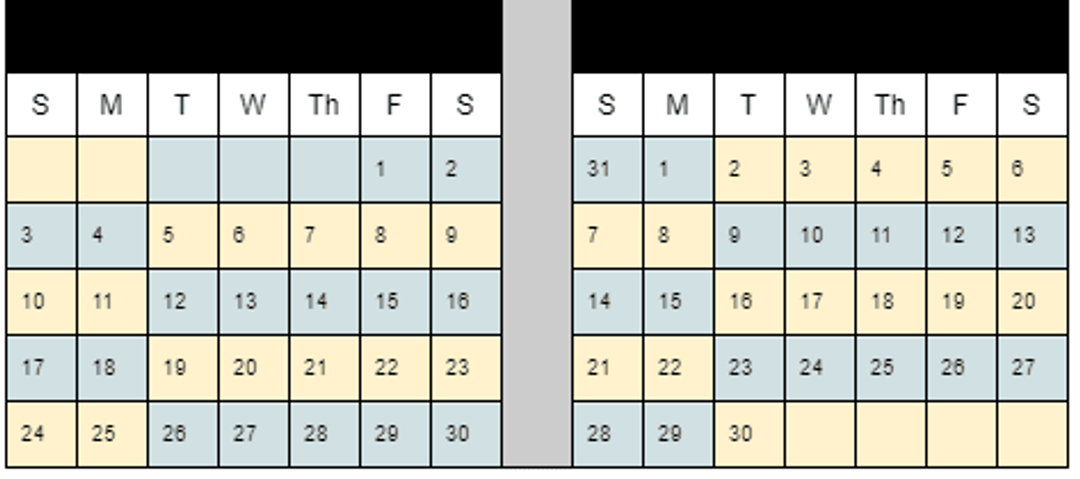

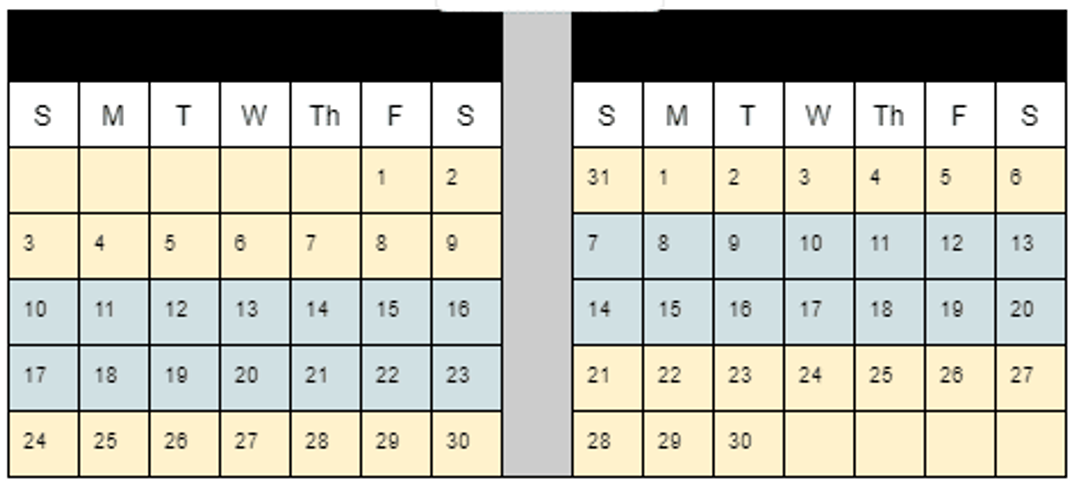

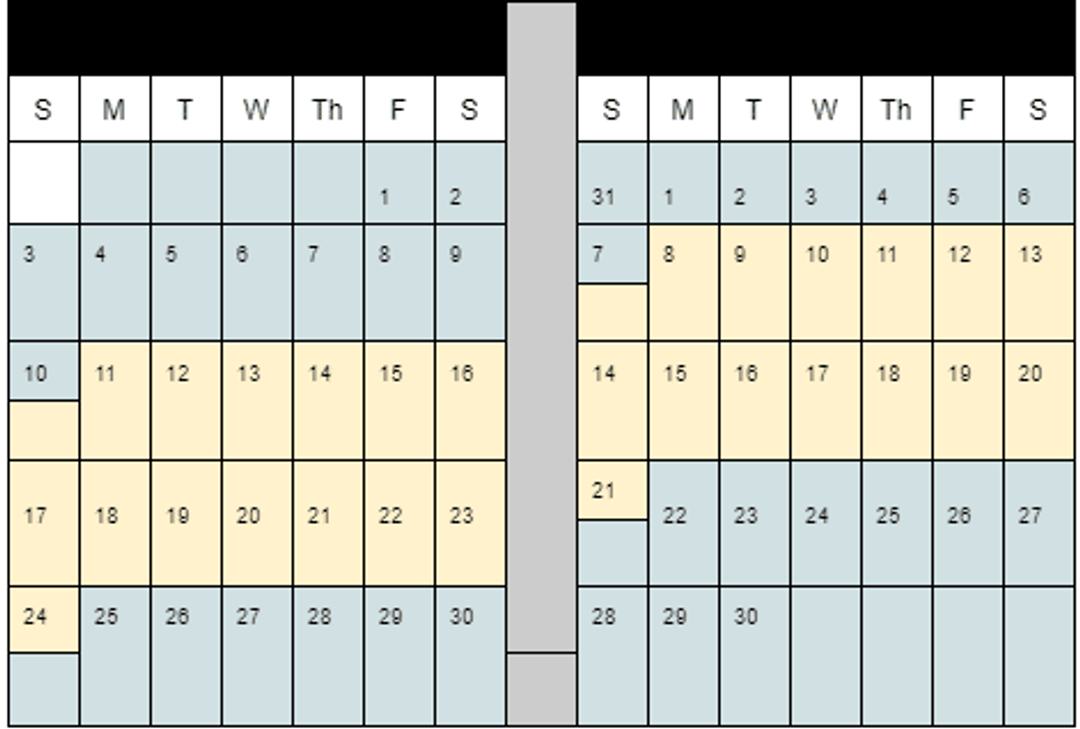

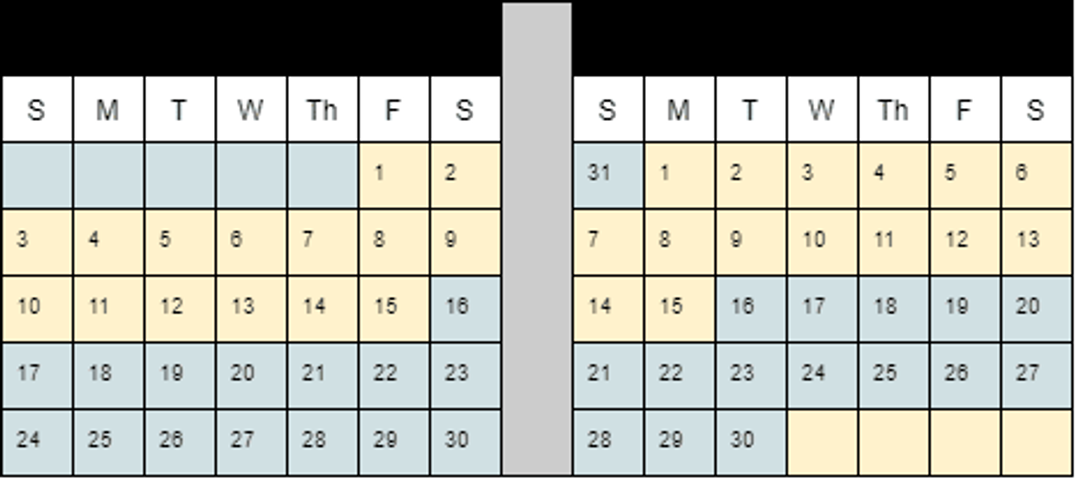

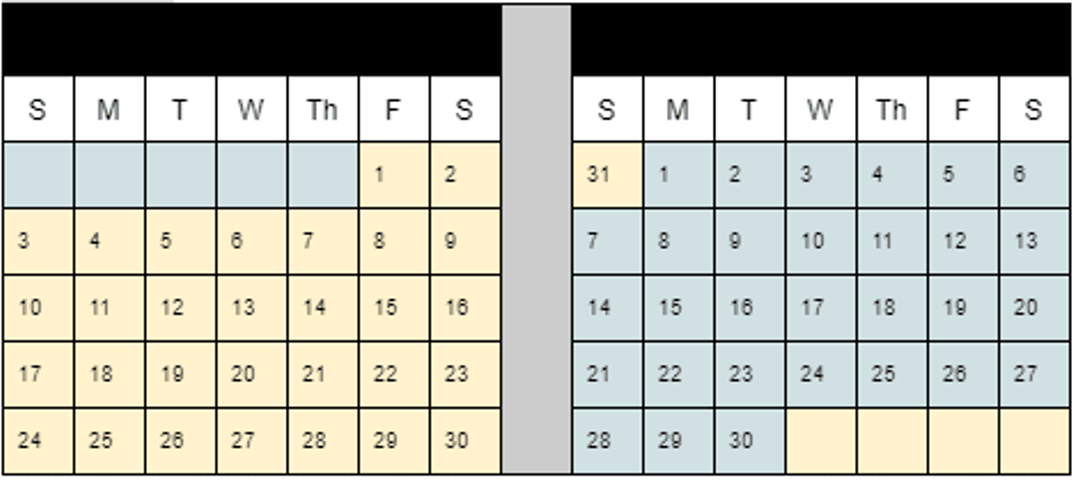

Here are a couple of examples of pay periods and what they could look like. Each pay period is shown in alternating color.

Weekly

Example One: Calendar Week

Example Two: Tuesday – Monday Week

Bi-weekly

Example One: Calendar Week

Example Two: 12 pm Sunday – 11:59 am Sunday

Semi-Monthly

Monthly

Topics

Samantha Kiper

Samantha is the HR Manager at an oil and gas midstream company. Her niche is the smaller mid-size company where you're in that in-between of having formal structured policies and procedures and where HR is just a thought of a concept. Samantha is a serial hobbyist - name it and she's probably dabbled in it.

Frequently asked questions

Other Related Terms

Eddy’s HR Mavericks Encyclopedia

Pay Period

Do you know that there are different types of pay periods? Understanding what a pay period is, what impacts it has, and how to go about selecting the best pay period for your business is important. Keep reading to get the low down on everything pay-period related.

What Is a Pay Period?

A pay period is a defined period of time used to calculate wages for payroll. The wages are calculated based on time worked during the defined period of time.

Pay Period vs Pay Date

While a pay period and a pay date (or pay day) go together, they are different. A pay date is the day on which funds are issued to the employee, paying them for their work during the associated pay period. There is usually a gap between a pay period and the pay date. Once a pay period has closed, the administrative process begins, reconciling the wages due from the pay period and calculating gross wages the employee earned. After the administration process has completed and the net payment is ready to be issued, the day it is paid out is the pay date.

Types of Pay Periods

There are several types of pay periods. Which you choose impacts how often the pay date occurs as well. Let’s start with the most common types of pay periods you will come across.

Weekly

This pay period captures time work during seven consecutive days. While it is common for businesses to choose the calendar week (Sunday through Saturday), pay periods can start and stop at any day or time of day as long as it is seven consecutive 24-hour periods. This type of pay period is common for labor industries with high turnover, like manufacturing and construction.

Bi-Weekly

It is also common for businesses to choose two consecutive calendar weeks (Sunday thru the second Saturday following) as a pay period. This can also start and stop at any time of day as long as it is 14 consecutive 24-hour periods. This type of pay period is common for general administrative staff and customer services.

Semi-Monthly

This pay period divides the month in half to have two pay periods a month. The first pay period is the 1st – 15th, and the second is the 16th - last day of the month. Because we’re focusing at a higher level on the month as a whole, semi-monthly pay periods run concurrently with calendar days. This type of pay period is common for exempt employees.

Monthly

A pay period may encompass a calendar month. The pay period starts on the first day of the month and ends on the last day of the month. Just like the semi-monthly pay period, it typically runs concurrently with the calendar month. This type of pay period is common for exempt employees and company executives.

Uncommon Pay Periods

There are a few other types of pay periods but they are not as common and typically are only used in certain industries. Daily. When employees are paid the same day they work, they are operating under a daily pay period. The pay date is usually the same day as the pay period. This can be common in gig type roles: musicians, bartenders, etc. Fixed Length/contract. This is common in school districts, where teachers sign a contract for one school year (typically 10 months) but are paid in increments as it is earned. They can choose to take their 10 months' earnings and be paid monthly for 10 months, or to divide their 10 months' earnings over 12 months to have pay dates over the summer break when they are not teaching.

Choosing the Right Pay Period for Your Business

Picking a pay period for your business isn’t hard, but it also shouldn’t be done without intention. Here are a few things to take into consideration when choosing a pay period.

Know the Law

Various laws impact payroll and wage calculation. The Department of Labor’s Wage & Hour Division established the Fair Labor Standards Act (FLSA). When most people think of FLSA, they think of minimum wage, but the FLSA covers way more than that. It establishes when to pay overtime and what is considered a work week, among other things. These things don’t necessarily dictate your pay period, but go hand-in-hand with the processing of it. FLSA is something you need to keep in mind. There are also state-level wage and hour laws. States have their own laws on how long the pay date can be from the pay period. There are also specific final pay laws that can fall outside of your standard pay period/pay date pattern. For example, in the state of Texas, if an employee is terminated involuntarily, the company only has six days to issue their last check. Depending on when the employee terminates, you could still be in a pay period where you are needing to close and process the terminated employee’s pay period while everyone else continues as normal.

Know Your Business/Accounting Needs

Have a discussion internally with your leadership and accounting teams to determine if there is anything on their end that needs to be taken into consideration. For example, it may be easier for a company to choose semi-monthly or monthly pay periods to go along with their standard month-end process. Bi-weekly and weekly pay periods may have them allocating part of a pay period to one month and the rest to the following month if the pay period straddles two months.

Know Your Demographic

One factor in choosing pay periods is understanding your employees, work schedules, and the industry you work in.

- Workforce.Is your workforce composed of business professionals who are primarily exempt status, or is it primarily laborers who turn over frequently? It makes more sense to have a longer pay period for higher-level positions that typically make higher incomes. If your workforce turns over frequently and you’re in states that have final pay laws, a shorter pay period will help cut down on deviating from your standard payroll processes.

- Operations. Do your staffing demands operate outside of the standard Monday-through-Friday/8–5 work schedule? Many technician-type roles have unique work schedules or shift work. For example, a company that employees work in 12-hour shifts that go from 6:00 am to 6:00 pm, you may consider having your pay period start at 6:00 am so a work shift doesn’t straddle two pay periods. Or maybe it helps decrease labor costs by having a shift straddle a pay period because of when the shifts fall into a work week under FLSA. Know that work shifts can impact how difficult and time-intensive paying your employees is.

- Industry. Does your industry have standards? It can be a big adjustment for someone to go from one type of pay period to a different one, especially if it is longer than what they are used to. If you are in an industry that typically uses a specific type of pay period, it may make sense to keep that industry’s practices. This can help alleviate issues that may arise when recruiting.

Examples of Pay Periods

Here are a couple of examples of pay periods and what they could look like. Each pay period is shown in alternating color.

Weekly

Example One: Calendar Week

Example Two: Tuesday – Monday Week

Bi-weekly

Example One: Calendar Week

Example Two: 12 pm Sunday – 11:59 am Sunday

Semi-Monthly

Monthly

Topics

Samantha Kiper

Samantha is the HR Manager at an oil and gas midstream company. Her niche is the smaller mid-size company where you're in that in-between of having formal structured policies and procedures and where HR is just a thought of a concept. Samantha is a serial hobbyist - name it and she's probably dabbled in it.

Frequently asked questions

Other Related Terms

Eddy's HR Newsletter

Sign up for our email newsletter for helpful HR advice and ideas.